Insurance is a complicated topic and with so many resourcesonline, it's often difficult for consumers to find key informationsuch as insurer rate comparisons and complaint data.

|Making matters even more challenging is the fact that insurancein the United States is regulated at the state level — incontrast to many other financial service providers, such as banks,which operate under significant federal oversight.

|The trillion-dollar insurance industry has 51 differentregulating bodies resulting in a widely varied approach toinsurance regulation and consumer services.

|State agencies graded and ranked

A new NerdWallet analysis looked at insurancedepartments across the country, evaluating their online offeringsand how helpful their websites are to consumers in their state.

|Related: Build a website your prospects will love

|The study examined the websites for all 50 states and theDistrict of Columbia, looking for information that would benefitconsumers the most. Researchers also called consumer helplines andemailed each insurance department. NerdWallet then graded eachagency on more than 20 factors that added up to a 100-point scale.(Visit the research methodology section for a morecomprehensive explanation of metrics and weightings.)

|Need for useful, timely online information

What did they find? The majority of departments had plenty ofwork to do to improve the consumer information they offer and howeasy it is to locate. One state, however, had a website that rankedwell above the rest and stands as a model for other states toemulate. Can you guess which state's insurance website ranked No.1?

|Here are the 20 most helpful state insurance websites forconsumers:

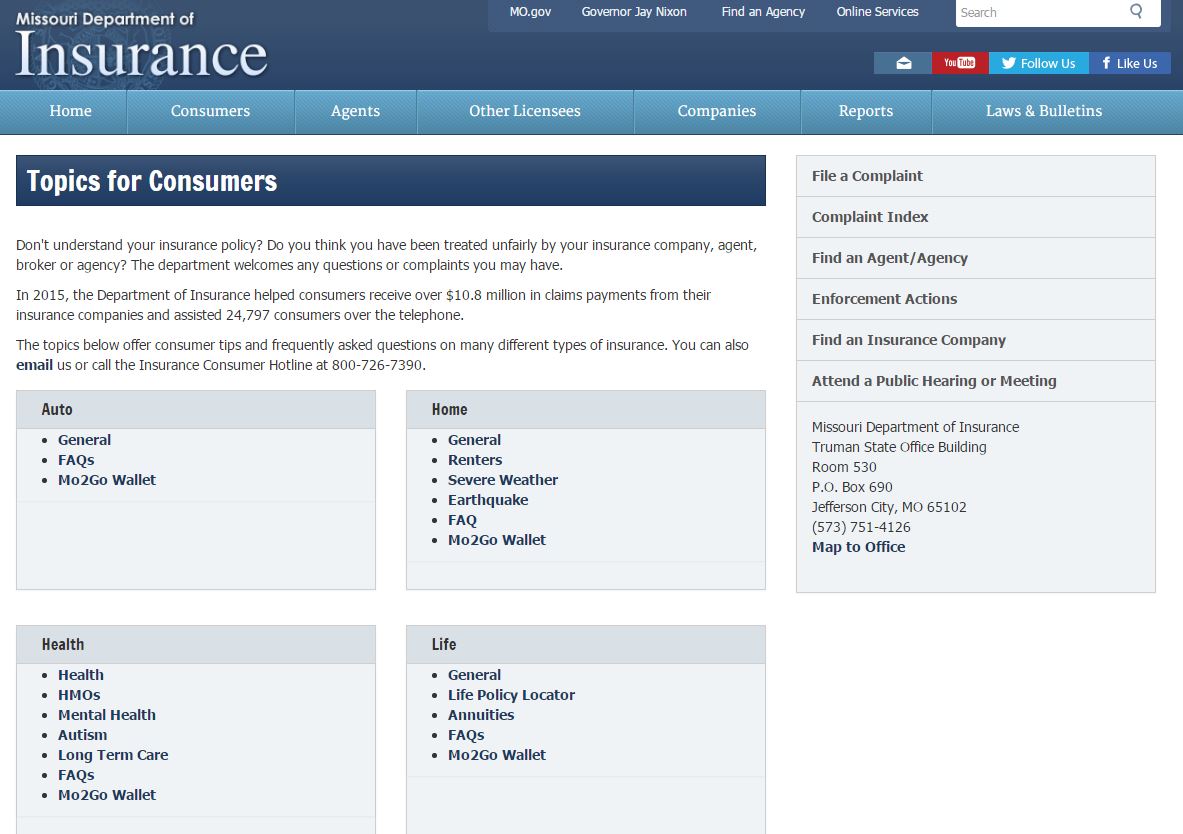

|MissouriDepartment of Insurance website.

|20. Missouri, Louisiana (2-way tie)

Final score: 67%

|At the time of the NerdWallet analysis, the MissouriDepartment of Insurance website lacked auto andhomeowners' insurance rate estimates. The state's score, however,was boosted by the presence of complaintinformation. Missouri's complaint index tool is reportedlyeasy to use and lets you view a company's last three years ofcomplaint information on one screen.

|The state has a consumer helpline, but the department lostpoints because researchers had to leave a message and waitapproximately 90 minutes for a return call to get their questionanswered. The department received full points for its educationalresources, and its Missouri-specific auto insurance guide was foundto be “particularly robust and user-friendly.”

|Louisiana Department ofInsurance website.

|The Louisiana Department ofInsurance scored above average, partly due to the presenceof premium comparison tools for auto and homeowners' insurance —both using 2015 data. It also scored maximum points for havingan easy-to-locate consumer helpline that answered a basic insurancequestion in less than one minute when called.

|The department has numerous consumer education resources acrossauto, home, health and life insurance, and NerdWallet determinedits guides are “well-written and contain helpful information.”

|Louisiana's score was negatively affected by the lack ofcomplaint information.

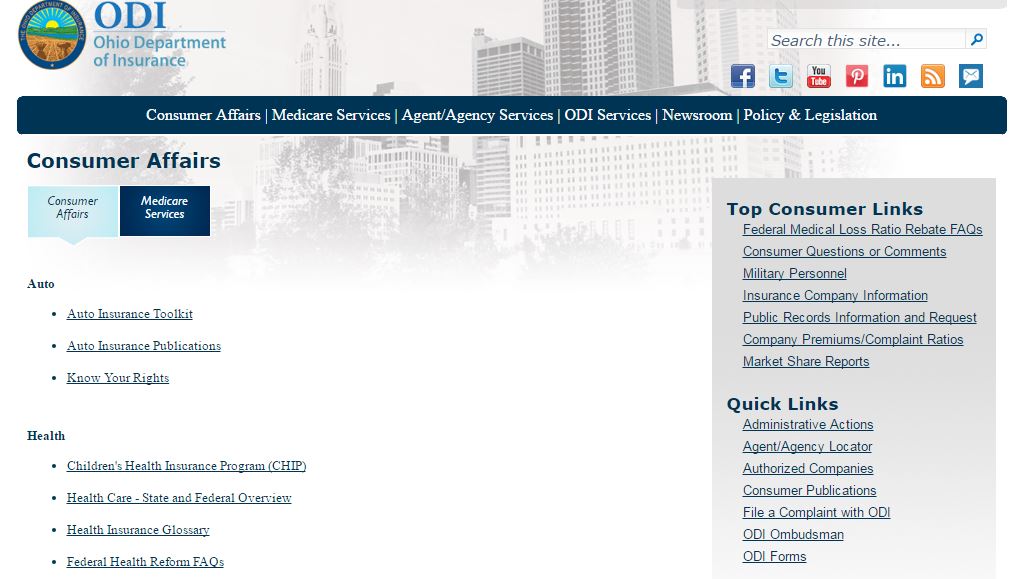

|Ohio Department of Insurance website.

|19. Ohio

Final score: 68%

|Consumers are able to easily find and use complaint comparisonsfor auto, health, homeowners' and life insurance onthe Ohio Department of Insurance website.However, at the time of scoring, complaint information was onlyavailable through 2014, which reduced the state's score.

|Researchers were able to locate numerous state-publishedinsurance guides on the website, and when we called the departmentto ask about auto insurance requirements, their question wasanswered in three minutes.

|The absence of auto and homeowners' insurance rate data on thewebsite was largely responsible for holding back the state'sscore.

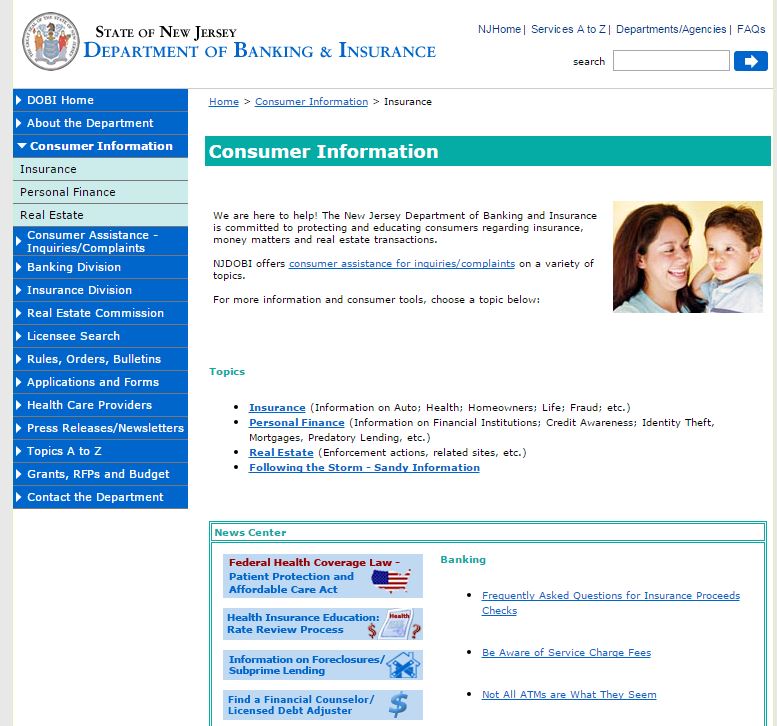

|New Jersey Department of Banking and Insurancewebsite.

|18. New Jersey

Final score: 69%

|The New Jersey Department of Banking andInsurance website provided auto premium comparisons andcomplaint information using 2015 data. However, at the time of thereview, the state did not extend these tools to any other insurancetypes.

|When the department's consumer helpline was called, an answer toan auto insurance question was received in just one minute. NewJersey scored well for consumer education resources, too, thoughmany of those resources were not state-specific.

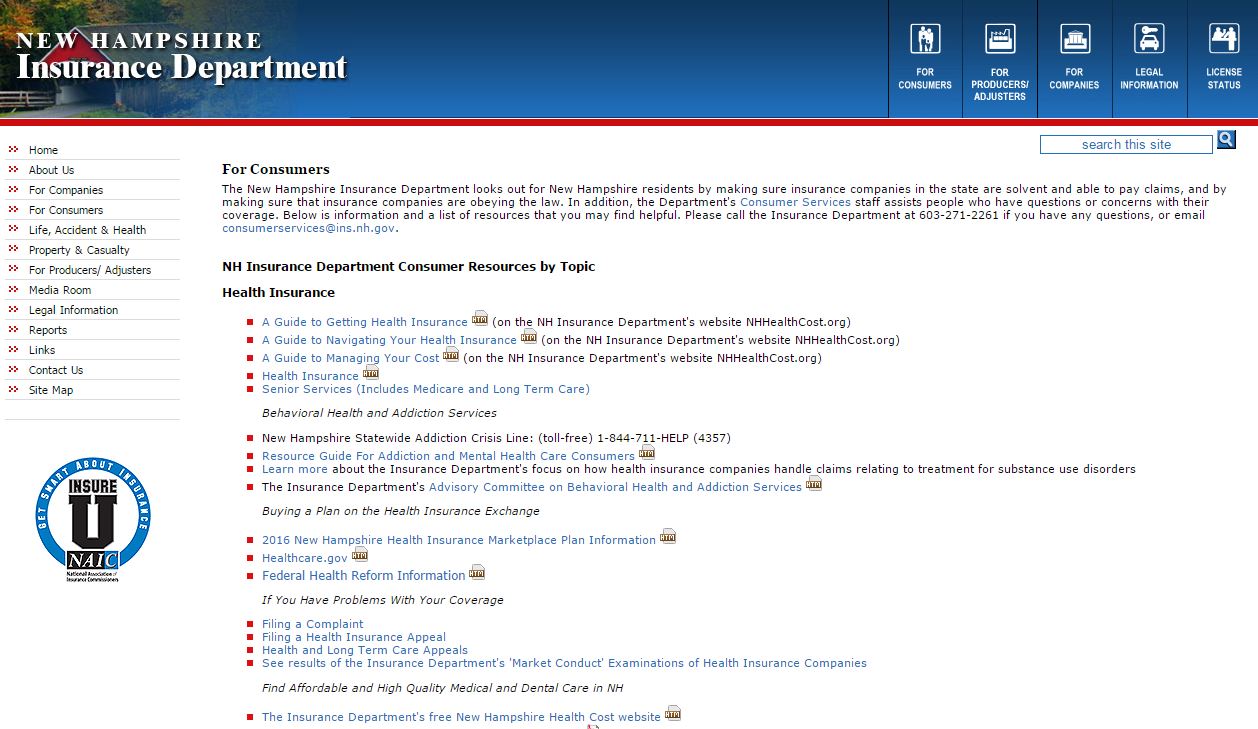

|New Hampshire Insurance Department website.

|15. New Hampshire, Arizona, Georgia (3-way tie)

Final score: 70%

|The New Hampshire Insurance Department tied withGeorgia and Arizona for the 15th-highest score.

|The department provides 2016 data in both its auto andhomeowners' insurance rate comparison reports. The state scoredfull points for these premium tools because they are “up-to-date,useful and easy to locate.”

|New Hampshire also received full points for its consumer guidesand resources, the majority of which are produced by thedepartment. The agency's “easy-to-find consumer helpline” was ableto answer a basic insurance question in less than two minutes whencalled.

|The only thing hurting New Hampshire's score was the lack ofcomplaint data at the time of this analysis.

|ArizonaDepartment of Insurance website.

|At the time of the NerdWallet analysis, the ArizonaDepartment of Insurance offered consumers the ability tocompare insurance rates for both auto and homeowners' policies. Theauto rate comparisons used 2015 data, but the homeowners'comparisons used 2014 data.

|The state makes limited complaint information available — 2014data for auto insurance and 2013 data for homeowners' insurance.The state lost points because these data were slightly out of dateand consumers can't compare complaint information for healthand life insurance.

|Arizona does have a dedicated consumer helpline, but when calledto ask for the minimum requirements for auto insurance in thestate, researchers were refused an answer and directed to otherstate agencies. However, the insurance department does list theserequirements on its website. Arizona has several useful consumereducational resources, and its website is reportedly easy tonavigate.

|Georgia Department of Insurance website.

|The website of the Georgia Department of Insurance scored aboveaverage thanks to its auto and homeowners' premium comparisons,which are based on the most recently approved rate filings from2016. However, the absence of complaint data had a significantnegative effect on the state's total score.

|Georgia received full points for the presence of consumereducation resources, including information on auto, health,homeowners' and life insurance. However, some of these resources,which were “narrowly focused, could be improved.” For example,there is no basic buying guide or general information source forhealth insurance, and NerdWallet determined the basic brochures forauto, homeowners' and life insurance could be more robust.

|When called, the state's consumer helpline provided an answer toa basic auto insurance question in less than two minutes.

|WashingtonOffice of the Insurance Commissioner website.

|13. Washington, Florida (2-way tie)

Final score: 71%

|The website of the Washington Officeof the Insurance Commissioner offered a “robust” complaintcomparison tool, according to NerdWallet. With it, consumers caneasily compare complaint information against all licensed insurancecompanies in the state. Based on 2015 data, the information canthen be sorted by company size, number of complaints or complaintindex.

|When researchers called the department's consumer assistanceline and asked about auto insurance requirements, they received aresponse within three minutes. Locating state-specific educationalresources on the site was easy; however, Washington failed toprovide rate comparisons at the time of the scoring.

|Florida Office of InsuranceRegulation website.

|Florida's website provided up-to-date premium data, but theinformation would have been more useful if it shared estimatesfor more than three driver profiles, according to NerdWalle. Theauto and homeowners' insurance complaints were also up-to-date,earning the state good scores in that category.

|Florida's overall score was held down by its lack of data oncomplaints against health and life insurance companies, as well asby how difficult it was to find some features on the website.

|Department spokesperson Karen Kees explained in an email toresearchers that while the Office of Insurance Regulation is incharge of regulating the insurance industry, the Florida Departmentof Financial Services handles complaint information and consumerassistance. In the NerdWallet analysis, the state was given creditwhen the insurance department linked to these resources on theFlorida DFS website.

|West Virginia Officesof the Insurance Commissioner website.

|12. West Virginia

Final score: 73%

|The website of the West Virginia Officesof the Insurance Commissioner offers consumers a way tocompare auto rates, but there wasn't a similar tool or report forhomeowners' insurance. The website also provides complaint data forauto, home, health and life insurance, although consumers may havea difficult time finding the information since it's buried in anannual report.

|NerdWallet determined that the complaint information could bemade more useful by providing context to the complaint totals —adding the size of each insurance company or a complaint ratio.

|There are educational resources, but little was available onhealth insurance. West Virginia has a dedicated consumer helpline,and when called with a basic insurance question, an answer wasreported received in a reasonable amount of time.

|Connecticut Insurance Department website.

|11. Connecticut

Final score: 74%

|The website of the Connecticut Insurance Department had the mostcomprehensive complaint database of all departments in NerdWallet'sanalysis. However, researchers concluded that the tool is “socomplex, it would be difficult for the average consumer to comparecomplaints across insurance companies.” The website's lack ofpremium comparisons also kept it from scoring higher.

|The agency scored well when it came to consumer assistance, withthe presence of an “easy-to-find consumer helpline” and answers totheir auto insurance question in less than two minutes. The websitefeatures consumer education resources, including a separate list ofcommon terms and definitions, for each major line of insurance.

|California Department of Insurance website.

|10. California

Final score: 75%

|The website of the California Department of Insurance received fullpoints for its insurance rate estimates because of a “usefulinteractive tool based on updated numbers.” California also sharescomplaint information across auto, homeowners' and life insurers,but only included 2014 data at the time of our analysis. Accordingto department spokesperson Nancy Kincaid, the 2015 data was slatedto be added in September.

|Complaint information against health insurance companies wasmissing.

|California does provide consumers with useful educationalmaterials.

|ArkansasInsurance Department website.

|8. Arkansas, Pennsylvania (2-way tie)

Final score: 76%

|The website of the Arkansas Insurance Department ranked eighth inthe analysis, tied with Pennsylvania. Its high ranking was largelydue to the presence of both premium comparison information for autoand homeowners' insurance and complaint data across auto, home,health and life insurance.

|The complaint comparison tool was found to be “comprehensive andeasy to use,” but the state's score would have been higher had thecomplaint data been more recent. The state has “useful educationalresources across all insurance types.”

|When researched called the department's consumer helpline, theyhad to leave a voicemail. It took approximately three hours toreceive a call back.

|Pennsylvania Insurance Departmentwebsite.

|The Pennsylvania Insurance Department websitefeatures complaint information across all four major lines ofinsurance using a searchable and sortable tool. This boosted thestate's score considerably, helping Pennsylvania rank eighth, tiedwith Arkansas.

|The state has a dedicated consumer helpline that proved “quickand helpful” when called, and the website features educationalresources — several of them specific to Pennsylvania — across auto,health, homeowners' and life insurance.

|The absence of any way for consumers to compare home and autoinsurance rates at the time of the analysis was the main thingholding Pennsylvania back from a top score.

||South CarolinaDepartment of Insurance website.

|7. South Carolina

Final score: 81%

|The South CarolinaDepartment of Insurance website features price comparisontools for auto and homeowners' insurance based on 2016 rates. Thestate also gives consumers a few ways to view insurance complaintsby company — one in a searchable database where you can look up onecompany at a time, and another showing complaint totals listedalongside the companies' sample premiums. NerdWallet fround “bothare useful but could be easier to locate. Putting the number ofcomplaints in context of the size of the insurance company wouldalso be more helpful.”

|When NerdWallet called the department's consumer helpline with aquestion about auto insurance limits, they had to leave a voicemailand did not receive a return call until the following day, whichaffected the agency's score.

|The state received full points for its educational resources,many of which were recently updated and state-specific.

|Kentucky Department ofInsurance website.

|6. Kentucky

Final score: 83%

|The Kentucky Department ofInsurance received full points for its premium comparisontables, as the data provided were “recent, easy to find on thewebsite and useful.” While the department does share complaint dataacross auto, homeowners', health and life insurance, theinformation is from 2014, making it slightly less useful than newerdata. The delay in publishing more recent information is due to theamount of time it takes “to ensure the complaint ratio is correctprior to posting,” said Ronda Sloan, a department spokesperson, inan email to NerdWallet.

|“The Kentucky website may not be flashy, but it is highlyfunctional — things are easy to locate and use,” according toNerdWallet.

|UtahInsurance Department website.

|5. Utah

Final score: 86%

|The website of the UtahInsurance Department did well, thanks in large part to theavailability of auto and homeowners' premium comparisons and somecomplaint information. The state could have scored higher, but itlacked complaint information for health and life insurers.

|Utah has a dedicated consumer helpline, and when called to ask abasic insurance question, researchers received a prompt and helpfulresponse. The state offers consumer education resources for auto,health, homeowners' and life insurance.

|Researcher concluded, “The site would benefit from Utah-specificpublications and resources, including an auto insurance guideexplaining state requirements.”

|Maryland Insurance Administration website.

|4. Maryland

Final score: 87%

|The Maryland Insurance Administration had thefourth-highest score in the NerdWallet analysis. The statepublishes up-to-date premium comparisons for auto and homeowners'insurance in its annual guides. The agency also publishes complaintdata for all four major lines of insurance — auto, health,homeowners' and life — in the administration's annual reports.While these data are useful, and Maryland received full points forit, the information is “difficult to find in an appendix of adocument more than 100 pages long.”

|NerdWallet also determined, “The website could be moreuser-friendly.”

|The site received full points for its state-specific consumereducation resources, which were produced by the department. Whenresearchers called the agency's consumer helpline to ask a basicinsurance question, they had an answer within four minutes.

|Colorado Division of Insurance website.

|3. Colorado

Final score: 91%

|The website of the Colorado Division of Insurance performedstrongly, thanks in part to its use of 2015 rate comparison andcomplaint data. The state's premium comparison tool is “easy tolocate and use, and the complaint reports are comprehensive andsortable.”

|When researchers called the consumer helpline, they received aprompt answer to a basic question about auto insurance.

|The state received full points for consumer education resources,“though it would be beneficial if more of these were specific toColorado.” NerdWallet found it odd that the resources are hosted onGoogle Drive rather than the department's website, “but that didn'tseem to affect usability.”

|The only points Colorado missed in the analysis were due toseveral features that “took numerous clicks to locate.”

|KansasInsurance Department website.

|2. Kansas

Final score: 93%

|The KansasInsurance Department earned the most points possible forboth its premium and complaint comparison tools, largely becauseboth are based on 2015 data and are easy to use. “One possible areafor improvement: adding a link to complaint information from theconsumer home page. At the time of our analysis, the comparisonswere somewhat difficult to find, under 'Publications,'” NerdWalletstated.

|Kansas also provides consumers with helpful resources, includingstate-specific insurance buying guides.

|When researchers called to get a basic insurance questionanswered, they received a return call within seven minutes — theshortest wait for a return call from any department.

|Texas Department of Insurance website.

|1. Texas

Final score: 98%

|The website of the Texas Department of Insurance scored thehighest in NerdWallet's analysis. The state's website providesup-to-date rate comparisons for auto and homeowners' insurance thatare “useful and easy to find,” according to NerdWallet.

|Complaint information is comprehensive, showing the number ofcomplaints for every company licensed to do business in the state,as well as a complaint ratio to put the numbers in context.

|When NerdWallet called the consumer helpline with a questionabout auto insurance, they received an answer in two minutes.

|Finally, the state has comprehensive, state-produced insuranceeducation resources, including helpful glossaries. The only pointdeduction for Texas was because the educational resources were alittle difficult to find.

|Related:

|Insurance websites need to bemobile-friendly — it's about more than justlooks

|Does your insurance agency website need amakeover? Avoid these mistakes

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.