Just in time for the summer movie blockbuster season, "San Andreas," an action-packed disaster thrillertelling the fictional story of the aftermath of a magnitude 9earthquake along the infamous San Andreas Fault in California, hits theaters. Whilethe movie will undoubtedly be entertaining, it's also a goodreminder to be prepared for Mother Nature's wrath.

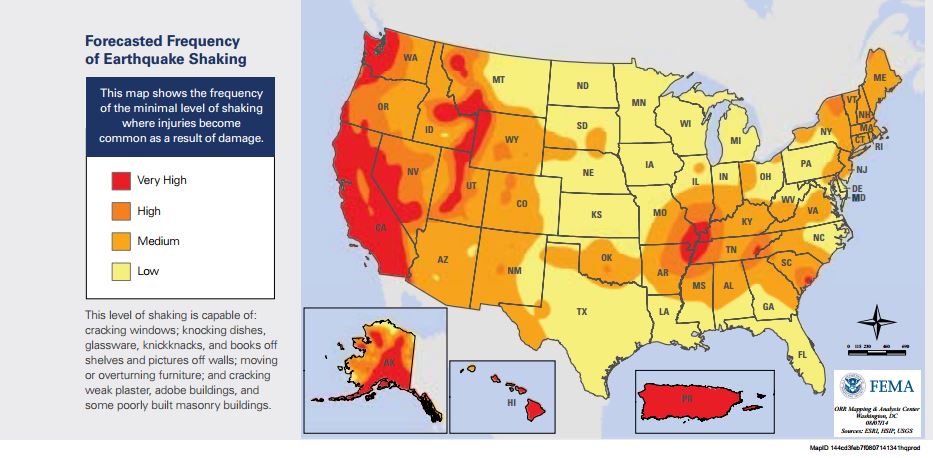

|Earthquakes can happen at any time of the year and occurwithout warning. While California has been the state mostprone to serious earthquakes in recent years, there are many otherfault zones in other areas of the United States. All 50 statesand 5 U.S. territories are at some risk for earthquakes. As shownon the map below, 45 states and territories in the U.S. areconsidered at "moderate to very high risk" of earthquakes.

|[From How To Prepare for an Earthquake, FEMAORR Mapping & Analysis Center, Washington, DC, 08/07/14.Sources: ESRI, HSIP, USGS]

|According to the Centers for Disease Control andPrevention (CDC), geologists and seismologists havepredicted a 97% chance of a major earthquake in the New Madridseismic zone of the central U.S. (including Arkansas, Missouri,Tennessee and Kentucky) between now and 2035. A March 2015 forecast from the U.S. GeologicalSurvey (USGS) has upped the likelihood that Californiawill be hit by a magnitude 8 earthquake over the next 30 years to7% from 4.7% forecast in a 2008 report.

|[Related: Ground-shaking facts about U.S.earthquakes]

|Take action now, before an earthquake hits, to secure yourproperty and help prevent injuries at home and at your place ofbusiness. Also, keep reading to learn more about protectingyourself financially with earthquake insurance.

||

Steve Brody inspects damage to the interior of his mobilehome after an earthquake Sunday, Aug. 24, 2014, at the Napa ValleyMobile Home Park, in Napa, Calif. A large earthquake causedsignificant damage and left at least three critically injured inCalifornia's northern Bay Area, igniting fires, sending at least 87people to a hospital, knocking out power to tens of thousands andsending residents running out of their homes in the darkness. (APPhoto/Ben Margot)

|Do a hazard hunt for things that might fall

- Cabinet doors should be secured with latches to preventcontents from crashing to the floor.

- Items on shelves and tables such as framed photos, books,and lamps should be secured with hooks, adhesives, or earthquakeputty to keep them from becoming flying hazards. Move breakable orheavy items to lower shelves.

- Mirrors, picture frames, and other hanging items should besecured to the wall with closed hooks or earthquake putty. Do nothang heavy objects over beds, sofas, desks, or any place you may beseated.

- Secure electronics such as computers, televisions, andmicrowave ovens with flexible nylon straps.

- Tall furniture like bookcases, filing cabinets, and chinacabinets should be anchored to wall studs (not drywall, ormasonry). Use flexible straps that allow them to sway withoutfalling to the floor.

- Major appliances like your water heater and refrigerator shouldbe secured with the appropariate straps screwed into the wall studsor masonry to help keep them from falling over and rupturing gas orelectric connections. Gas appliances should have flexibleconnectors to absorb the shaking while reducing the risk offire.

- Brace overhead light fixutures.

All the adhesives, straps, hooks, latches, and other safetydevices mentioned above are available at most hardware andhome improvement stores as well as online retailers.

||

(Photo: Baloncici /Shutterstock.com)

|Strengthen buildings

|Examples of structures that may be more vulnerable in anearthquake are those not anchored to their foundations orstructures that have weak crawl space walls, unbraced pier-and-postfoundations, or unreinforced masonary walls or foundations.

|Make sure your home and other buildings where you spend time aremore resistant to earthquake damage.

- Install foundation bolting, cripple wall bracing, and reinforcechimneys in your home and business.

- If you live in a mobile home, consider installing anearthquake-resistant bracing system

Tip: Did you know that doorways are no strongerthan any other part of a structure? Don't rely on doorways forprotection. During an earthquake, the American Red Cross recommends getting under asturdy piece of furniture and holding on. It will help shelter youfrom falling objects that could injure you during anearthquake.

||

An apartment building on fire as a result of the Northridge,Calif., earthquake in 1994. (Joseph Sohm /Shutterstock.com)

|Key earthquake preparations to protectproperty

- Learn how to shut off the gas valves in your home and business.Keep a wrench handy for that purpose.

- Create and maintain an emergency supplies kit in aneasy-to-access location

- Gather and store important documents in a fire-proof safe.Include:

- |

- |

- Birth certificates

- Ownership certificates (automobiles, boats, etc.)

- Social Security cards

- Insurance policies

- Wills

- Household inventory

- |

- Replace glass bottles from your medicine cabinet and around thebathtub with plastic containers.

- Identify poisons, solvents, or toxic materials in breakablecontainers and move these containers to a safe, well-ventilatedstorage area.

A chimney from a damaged house in Los Angeles leaningagainst another house after a January 17, 1994, earthquake. (JosephSohm / Shutterstock.com)

|Earthquake insurance

|Earthquakes in the U.S. are not covered under standardhomeowners, renters, or business insurance policies, according tothe Insurance Information Institute. Coverageis usually available for earthquake damage in the form of anendorsement to a home or business insurance policy. Earthquakeinsurance is available from most insurance companies in moststates.

|California law requires homeowners insurance companies to offerearthquake coverage to their homeowners insurance policyholders.Homeowners can decide to purchase it, purchase a policy fromanother insurer or decline it altogether.

|Earthquake insurance provides protection from the shaking andcracking that can destroy buildings and personal possessions.Coverage for other kinds of damage that may result fromearthquakes, such as fire and water damage due to burst gas andwater pipes, is provided by standard home and business insurancepolicies in most states. Cars and other vehicles are coveredfor earthquake damage under the comprehensive part of the autoinsurance policy.

|Unlike flood insurance, earthquake coverage is available fromprivate insurance companies rather than from the government. InCalifornia, homeowners can also get coverage from the California Earthquake Authority (CEA), a privatelyfunded, publicly managed organization.

|Earthquake insurance deductibles and costs

|Earthquake insurance carries a deductible, generally in the formof a percentage rather than a dollar amount. Deductibles can rangeanywhere from 2% to 20% of the replacement value of the structure.This means that if it cost $100,000 to rebuild a home and there was2% deductible, the consumer would be responsible for the first$2,000 dollars.

|Insurers in states like Washington, Nevada and Utah, with higherthan average risk of earthquakes, often set minimum deductibles ataround 10%. In most cases, consumers can get higher deductibles tosave money on earthquake premiums.

|The standard California CEA policy includes a deductible that is15% of the homes' replacement cost. The basic policy covers onlythe house (other structures such as garages, pools, etc. are notcovered). Personal possessions are covered up to $5,000 and "lossof use" expenses, the additional cost of living elsewhere whilehome repairs are made, are covered up to $1,500.

|Recognizing that some people want more comprehensive coverage,the CEA also offers a 10% deductible, insurance for otherstructures, personal items coverage up to $100,000 and $15,000 in"loss of use" coverage. Premiums vary widely among the 19 ratingterritories, based on the type of house, its age, the nature of thesoil, and proximity to known fault lines. The CEA has reserves ofabout $9 billion.

|Premiums vary widely

|Premiums also differ widely by location, insurer and the type ofstructure that is covered. Generally, older buildings cost more toinsure than new ones. Wood frame structures generally benefit fromlower rates than brick buildings because they tend to withstandquake stresses better.

|Regions are graded on a scale of 1 to 5 for likelihood ofquakes, and this may be reflected in insurance rates offered inthose areas. The cost of earthquake insurance is calculated on "per$1,000 basis." For instance, a frame house in the Pacific Northwestmight cost between one to three dollars per $1,000 worth ofcoverage, while it may cost less than fifty cents per $1,000 on theEast coast.

|A brick home would cost approximately $3 to $15 dollars per$1,000 in the Pacific Northwest, while it would cost between 60 to90 cents in New York.

|Number of people buying earthquake insurance hasdeclined, while risk is increasing

|According to a 2014 InsuranceInformation Institute survey, 7% of American homeowners haveearthquake insurance, down from 10% in 2013 and 13% in 2012. In theWest, this measure fell from 22% in May 2013 to 10% in May2014.

|Seven percent of homeowners in the Midwest have earthquakeinsurance. In the South the proportion of homeowners who said theyhad earthquake coverage stood at 6%. Only 2% of homeowners in theNortheast said they have earthquake insurance. Eleven percent ofhomeowners earning $100,000 or more said they had earthquakeinsurance, down from 18% a year ago. Only 2% of homeowners whoearned less than $35,000 said they had earthquake insurance in2014, down from 6% in 2013.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.