"Insurers are concerned about fraud,"says Mark McElroy, head of insurance for TransUnion. "The abilityfor fraud or fraud-related transactions to go undetected ispresenting them with a significant amount of brand reputation atstake." (Photo: Shutterstock)

"Insurers are concerned about fraud,"says Mark McElroy, head of insurance for TransUnion. "The abilityfor fraud or fraud-related transactions to go undetected ispresenting them with a significant amount of brand reputation atstake." (Photo: Shutterstock)

The insurance industry has long dealt with theissue of fraud, but its impact has multiplied ascompanies have expanded their presence to theinternet. Insurers must not just consider the economic impact offraud, but also the way in which fraud — and all the false alerts,detection and prevention procedures, and investigations that gowith it — impacts their customers' experience.

|Customers demand exceptional experiences in orderto retain their business, so combating fraud is critical forany insurer. To understand the state of fraud within theinsurance industry, TransUnion commissioned ForresterConsulting to evaluate the landscape.

|Related: Secrets to combating insurance fraud with dataanalytics

|The fraud life cycle

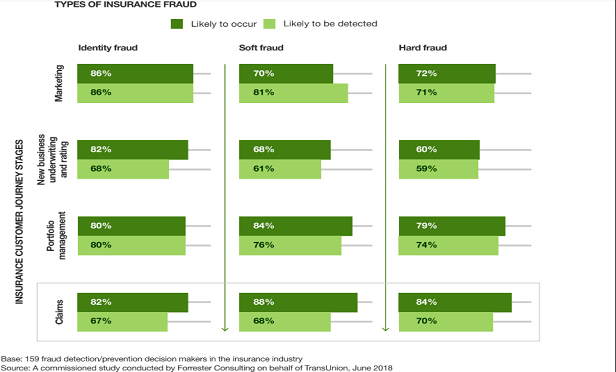

One particular aspect of fraud that makes prevention sodifficult is that it can occur at any point during the policy lifecycle. However, insurance professionals say all types offraud are most likely to be detected during the marketing phase as the insurer looksto acquire a new customer. This is the least expensivephase for fraud detection.

| Fraud decreases customer engagement anddeters potential customers from purchasing additional insurancepolicies with the company. (Photo: Forrester)

Fraud decreases customer engagement anddeters potential customers from purchasing additional insurancepolicies with the company. (Photo: Forrester)

But fraud may be going undetected at other stages, especiallyduring claims. In fact, the largest gap between occurrence anddetection rates for all types of fraud exists in the claim stage.This leaves firms vulnerable to fraudsters who either focus on other stages or are able to get past theinitial marketing stage undetected.

|Fraud detection and prevention requires teams to have expertisein skills like data science, fraud management and investigation. Alack of professionals with the skills to detect fraud is cited as amajor challenge for employers, as well as training and educatingemployees, and a lack of flexibility to adjust in real time.Combined, these factors can lead to poor customer experiences.

|Related: Are you missing fraud with outdatedtech?

|The cost of fraud

Fraud (including false alerts and investigations) is detrimentalto the health of an insurer's business. Respondents believe thatthe No. 1 impact to the business is damage to the brand and reputation, but thereare financial ramifications, too. Losses from write-offs,non-compliance fines, lawsuits, investigation costs, and legal andpublic relations costs also are direct impacts of fraud.

|"Insurers are concerned about fraud," says Mark McElroy, head ofinsurance for TransUnion. "The ability for fraud or fraud-relatedtransactions to go undetected is presenting them with a significantamount of brand reputation at stake."

|Fraud also decreases customer engagement and deters potential customersfrom purchasing additional insurance policies with thecompany. Additionally, firms worry good customers can getcaught in the detection process, flagging them in error anddamaging the overall experience.

|While many insurers have some sort of fraud prevention anddetection tools in place, 98% of survey respondents are eitherplanning to adopt, currently adopting or already have a solution inplace. Insurers should select solutions that supportidentity verification and theft detection, screening, as well astransactional insurance claims and payment fraud.

|Fraud may always be something the insurance industry has to dealwith. But rather than it impacting an insurer's financial standing,as well as the customer experience, companies can work tounderstand the evolving nature of cyber and invest in ways thatactively detect and prevent fraud with the customer experience inmind.

|Related: How insurers can identify fraudulent claims beforethey are paid

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.