Those in claims management agree on one thing — litigation, oreven attorney representation, leads to greater claims and expensecosts than would otherwise occur. And in Workers' Compensation circles, an attorney mayactually reduce the employee's compensation rather than add toit.

|This may occur because:

The statutory benefits are clear and cannot be increased for anyreason, and an attorney receiving these benefits reduces the amountof money remaining for the employee,

The claimant's attorney is inexperienced in Workers'Compensation and may settle for less than the adjuster would haveotherwise settled.

The reduced payment to the employee or a liability claimant mayalso occur because claimants may try to negotiate a settlementthemselves initially but hire an attorney later in the process. Ifthe claimants eventually pay the attorney a percentage of the fullsettlement rather than just a percentage of the incremental awardcreated by the attorney's involvement, then the claimant'sfinancial outcome is reduced.

|This does not mean there is no place for claimants to obtainlegal representation. Some insurers, third-party administrators andcompanies have inadequately or improperly managed claims, causingsome claimants or plaintiff's attorneys to view insurersnegatively. Some claims are appropriately denied and a claimant'sdisagreement with the denial will lead to legal representation.

|Confusing process

Employees or claimants with bodily injury claims may seek legalrepresentation, especially if they fear they do not understandenough about the process to effectively present their case andnegotiate a settlement themselves. Those in the claims arenaunderstand what is needed to present a claim, but it is a confusingprocess for anyone who has not been trained in claimsmanagement.

|This uncertainty in an employee's or claimant's mind is afrequent reason for the involvement of plaintiff's attorneys. Theyfocus on fears that the insurance companies are just out to makemore money, inferring that they will settle for less than theyshould, and that they have big pockets. They will also throw outalleged examples of big awards or settlements they have reachedwithout clarifying whether the award or settlement was really anincrease over what the claimant would have received anyway. This isprecisely why it is important to address the claimant's concernsand fears.

|Continue reading…

|

While nothing new to seasoned adjusters, these actionsreduce a claimant's uncertainty about a claim. (Photo:iStock)

|The “I wills”

It's important to start with some basic assumptions andcommitments, which I refer to as the “Iwills.”

|I will:

Deal honestly and ethically with everyone involved in thisclaim.

Treat everyone with respect.

Promptly contact all parties involved in a claim within oneworkday of assignment.

Initiate the investigation at the time of first contact, followthrough on additional investigation that may be required, and reachan early decision of acceptance, denial or compromise.

Notify the claimant as soon as I have made a decision aboutaccepting compensability or liability, regardless of thedecision.

Inform the claimant of the information and proof that is neededto consider all aspects of their accepted claim.

Provide the claimant with information from objective thirdparties that confirms what they need and why (e.g., SCHIP 111 rulesfor the claimant's social security number, WC statutes regardingbenefits and administrative requirements).

Respond to phone calls or e-mails within one working day of myreceipt.

Keep the claimants informed of my progress throughout the claimand of any additional information they need to provide based onchanges in their condition or treatment.

Evaluate all settlement components and make a verbal offerpromptly upon receipt of the necessary documentation.

While many will look at this list and think there is nothing newhere, I fully agree. However, a review of claims audits over thelast several years reveals that claims handling has become more ofa process-driven function with little communication andrelationship-building. This results in increased uncertainty by theclaimant, leading to more representation and eventually, morelitigation.

|Related: As an adjuster, do you know whom yourepresent?

|Continue reading…

How the “I wills” reduce claimants' fears

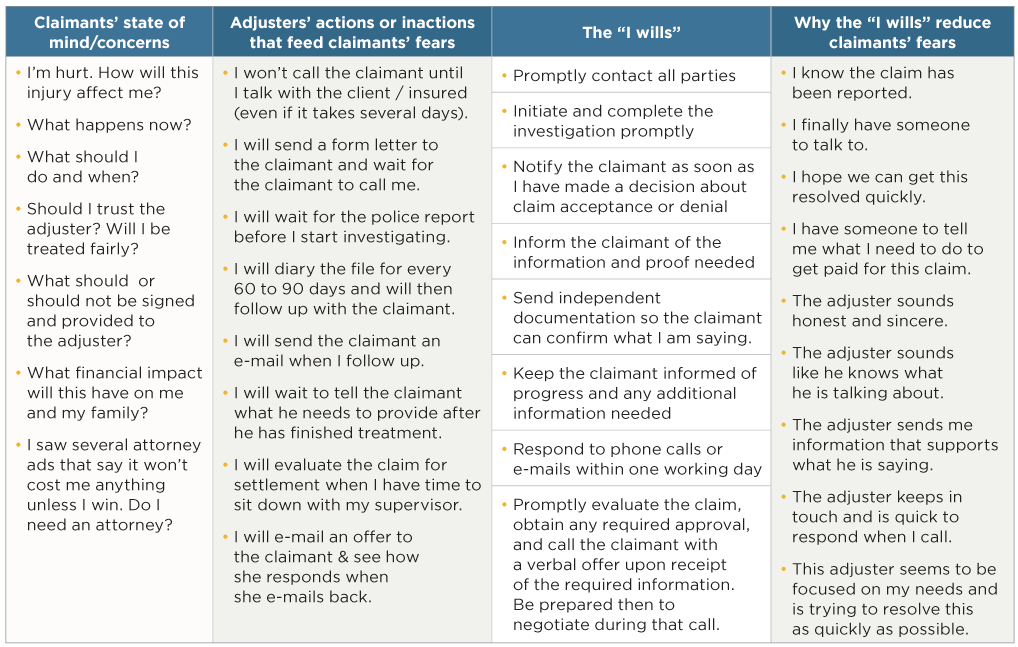

The following chart includes actions or omissions that feedclaimants' fears and how the “I wills” help reduce those fears.This requires returning to a more communicative approach that helpsdevelop rapport with the claimants and reach resolutions that maybe more satisfactory for everyone. Since dealing honestly andethically with all parties and treating them with respect should becore values in all claims operations, those particular “I wills”are not specifically included in this table. The actions orinactions described in this table that increase the claimant'sfears have been observed or inferred from claims audits.

|Following the “I wills” may have an even greater impact onimproving the outcomes of liability claims managed by or on behalfof public entities. Most public entities have a code or statutoryrequirement that automobile liability or various types of generalliability claims must be filed within a specified time from theloss on a particular form and/or with specific information.

|Increasing claimant's fears

In some cases public entities or their claims administratorsdelay taking any action even when there is significant injury andexposure and they have knowledge of the incident. They wait untilthe required form has been received by the legal department or thedepartment identified in the code and the form and content areconfirmed by the legal department.

|While they have met the letter of the statute, they have delayedworking on the claim, increasing the claimant's fears. This delaymay lead to attorney involvement and increased costs.

|The “I wills” are not new, but are becoming harder toincorporate into claims management because of industry automation.While these activities are useful tools in managing claims, they donot take the place of the effective communication and relationshipbuilding that often create better outcomes.

|Gary Jennings, CPCU, ARM, is the principal consultantat Strategic Claims Direction LLC. Hemay be reached at [email protected].

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.