According to the National Hurricane Center in Miami, the Atlantichurricane season runs from June 1st through November 30th everyyear. Some years are worse in terms of damage than others --2005 remains the busiest season for the Atlantic region on recordwith 28 named storms -- but every summer brings the potential forsignificant weather events between the Caribbean and easternCanada.

|(For what it is worth, many weather experts are predicting an unusuallyquiet year for hurricanes in 2015. Colorado State University haspredicted no more than seven named storms this year, three of whichwill be hurricane-strength, but only one that's a category 3 orhigher.)

|[Related: Florida’s hurricane-free stretch has Citizensbracing for storms]

|We aren't in the thick of hurricane season yet, but it is nevertoo early for homeowners and business owners in the potential pathof these storms to prepare for the worst, and that includes athorough annual review of their insurance coverage.

|The Insurance Information Institute (I.I.I.) has assembled thefollowing checklist for property owners in hurricane regions. Isthere anything else you would recommend for your clients in at-riskareas? Let us know in the comments or @PC_360.

||

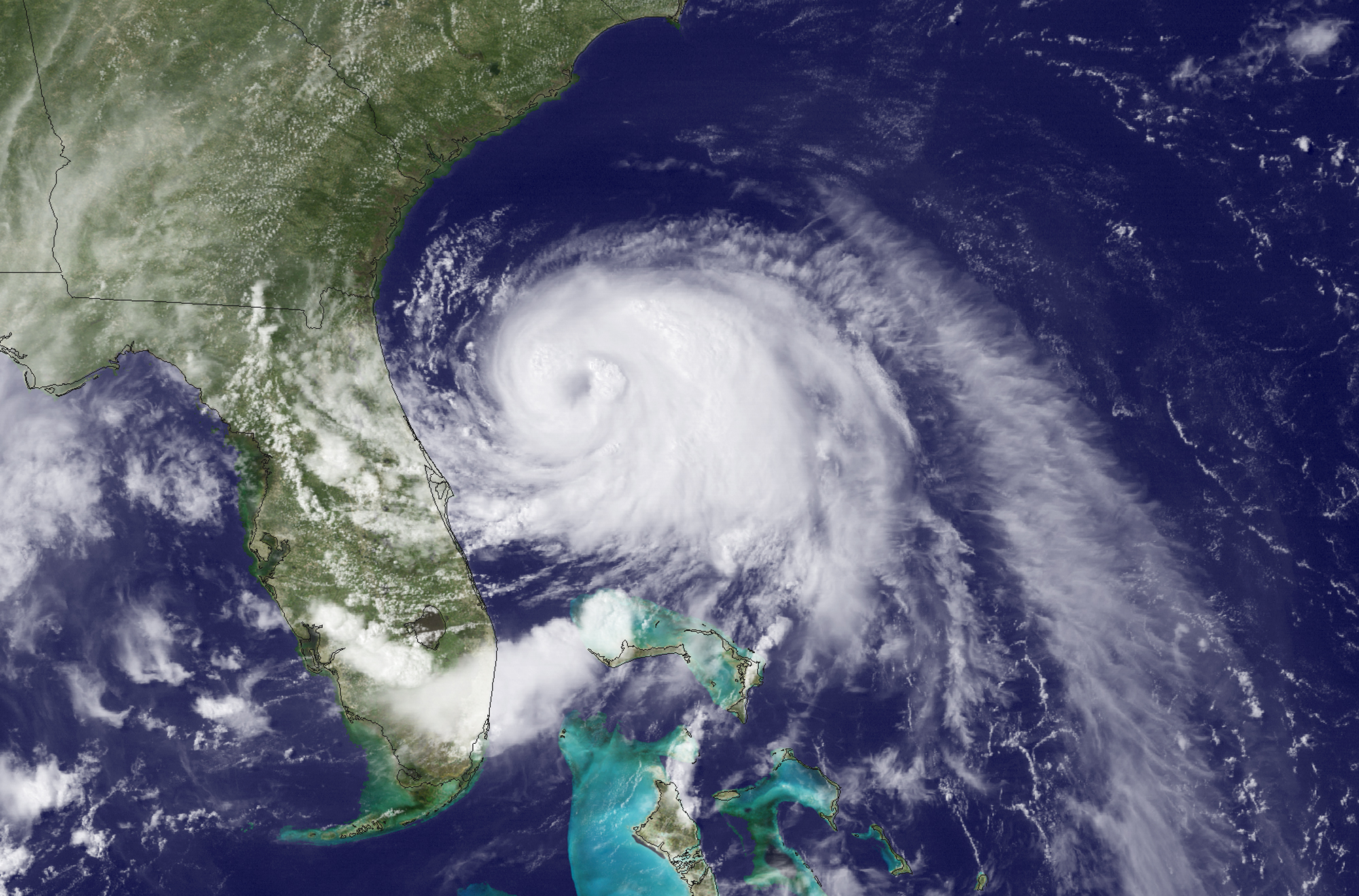

(Photo / Shutterstock)

|Is your policy limit enough to rebuild your home in theevent of a loss?

|The I.I.I. recommends the following homeowners coverages asadd-ons to help protect customers against the costs of rebuilding atotal loss:

- Extended Replacement Cost Policy – pays anadditional 20% or more above the policy limits.

- Guaranteed Replacement Cost Policy – pays thefull amount to rebuild your home whatever the ultimate cost.

- Inflation Guard – automatically adjusts thecoverage limits to reflect changes in constructioncosts.

- Ordinance or Law Coverage – pays a specifiedamount for rebuilding to new building codes, should your communityadopt stricter codes.

(AP Photo)

|Do you know the value of everything youown?

|I.I.I. writes: "Most insurers provide coverage for personalpossessions—approximately 50 to 70 percent of the amount ofinsurance you have on the structure of your home. Is this enough?The best way to determine what you actually need is to conducta home inventory—adetailed list of your belongings and their estimated value."

|The group also suggests that customers check what type ofinsurance they have in place for their belongings, whether it isreplacement cost coverage or actual cash value coverage.

||

(AP Photo)

|Does your policy provide enough Additional LivingExpenses coverage?

|This coverage will provide for basic living expenses in theevent that an insured's home is rendered uninhabitable by aninsured disaster, including hotel costs, food costs and otherexpenses.

|According to I.I.I.:

- "ALE coverage is generally equal to 20 percent of the amount ofinsurance coverage that you have on the structure of your house;however, most insurers offer the option of higher coveragelimits.

- Many policies provide ALE reimbursements only for a specificamount of time; make sure you’re comfortable with the time limitsin your policy."

|

(Photo / Shutterstock)

|What is the percentage of the hurricane/windstormdeductible stated in your policy?

|"Insurers in every coastal state from Maine to Texasinclude separate deductibles for hurricanes and/orwindstorms in their homeowners policies," the I.I.I. writes."Unlike the standard 'dollar deductible' on an auto or home policy,a hurricane or windstorm deductible is usually expressed as apercentage. It is clearly stated on the Declarations (front) pageof your homeowners policy."

|These deductibles range from 1% to 5% percent of a home'sinsured value, and only apply in the event of a specific type ofnatural disaster (a hurricane for a hurricane deductible and highwinds for a windstorm deductible).

||

(Photo / Shutterstock)

|What disasters does your insurance policycover?

|According to the I.I.I., "standard homeowners insurancepolicies provide coverage for hurricanes, wind, theft, fire,explosion, lightning strikes and a host of other disasters."However, watch for exclusions like flood or earthquake, which arenot covered.

|I.I.I. suggests the following additional coverages for customersin hurricane-prone areas:

- Sewer Back-Up Coverage

- Flood Insurance

|

Speaking of flood insurance, do you haveit?

|According to I.I.I., 90% of all natural disasters includeflooding, and hurricanes are most certainly on this list. As aresult, a separate flood insurance policy is important for anyonewho lives either in hurricane country or otherwise on a floodplain.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.