The OCC recently issued new civil money penalty guidance and Bank Secrecy Act/Anti-Money Laundering supervision procedures. The NCUA said although it will address CMPs during the board's June meeting, it does not currently plan to make changes to its BSA/AML regulatory regirm.

The OCC recently issued new civil money penalty guidance and Bank Secrecy Act/Anti-Money Laundering supervision procedures. The NCUA said although it will address CMPs during the board's June meeting, it does not currently plan to make changes to its BSA/AML regulatory regirm.

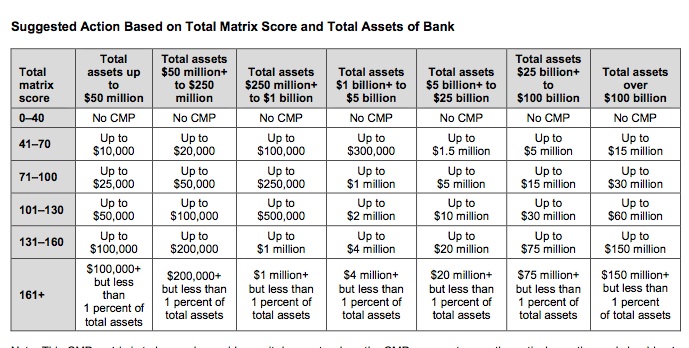

On Feb. 26, the OCC revised its Policies and Procedures Manual policy for assessing civil money penalties. The bulletin, which is guidance and not a formal rule, detailed a new CMP matrix for institutions.

The matrix included 11 factors to consider when rating the severity of the regulatory violation: Intent; continuation after notification; concealment; financial gain or other benefit as a result of violation; loss or risk of loss to the bank; impact or harm other than financial loss to the bank; loss or harm to consumers or the public (consumer law or Bank Secrecy Act violations), previous concern or administrative action for similar violation; history of violations and tendency to engage in violations; duration and frequency of violations before notification; and, effectiveness of internal controls and compliance program.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.