The numbers for mobile device bill pay usage have spiked in thepast year, and Eric Leiserson, senior research analyst for FiservBiller Solutions, said he is not surprised. In fact, he added, onlyconsumer adoption of online banking came close to the market sharemobile applications have captured on an almost daily basis.

|Results from the Seventh Annual Billing Household Surveyreleased in December by the Brookfield, Wis.-based Fiserv revealedrapid growth for mobile bill payment, Leiserson said. In 2012, 8million U.S. households made some sort of payment from a mobiledevice. By 2014, the number had risen to 27 million.

|“It's the classic 'hockey stick' adoption/diffusion scenario,”said the Atlanta-based Leiserson, referring to trends thatexperience a sharp uptick after a relative period of calm. “I getexcited about this because there's real value creation when you dothings with a mobile device.”

|According to the survey, 65 million U.S. online households nowhave a smartphone, and 40% of smartphone owners pay bills fromtheir phone. Overall, smartphone bill payers paid an average of twobills a month from their phones.

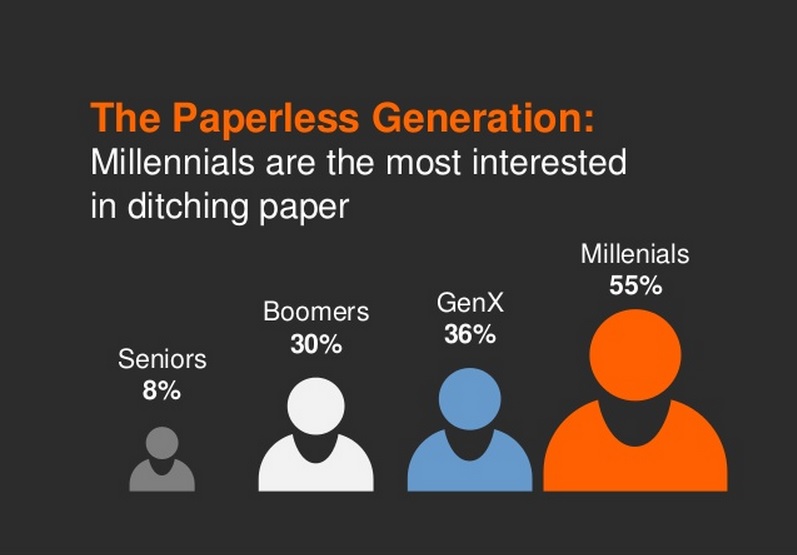

|The mobile bill pay market is even more robust for millennials.Among members of the demographic cohort born between 1980 and 2000,62% have paid a bill using their smartphone, and millennial userspaid an average of three bills a month from their phones.

|“We're observing tremendous growth in mobile that's happened forfinancial institutions, including credit unions, and it's growingbecause its creating value,” Leiserson said.

|The most popular bills paid via phone, according to the survey,included mobile (15 million), cable (14 million) and electricity (8million). In addition, the Fiserv survey found that amongsmartphone owners, 60% said that a mobile payment option wouldimprove their satisfaction with the biller.

|The convenience, ease and consumer service orientation makemobile bill payment a natural fit for credit unions, Leisersonsaid.

|“Credit unions are all about providing an amazing memberexperience,” Leiserson said. “If you don't have a compelling mobilestrategy or user experience, you risk lower member engagement forall types of activities. Ultimately, you become less relevantbecause the consumer will find other ways to make their mobilepayments.”

|Mobile bill payment's rapid growth has caught a lot ofinstitutions off guard, and many institutions are committingserious resources to become part of what is quickly becoming arunaway market, Leiserson said.

|“The stats are incredible,” Leiserson said. “They show consumerdemand and expectations to utilize and have available mobileexperiences that rival Amazon or PayPal. Big banks spending a lotof money, time and energy to reimagine the financialexperience.”

|Read more: Credit unions scramble to catch up…

| Credit unions, too,have entered the game, but at a slower rate, the analyst said. Insome cases, credit unions are scrambling to catch up with what isno longer an emerging technology one that ideally is part of anintegrated delivery package.

Credit unions, too,have entered the game, but at a slower rate, the analyst said. Insome cases, credit unions are scrambling to catch up with what isno longer an emerging technology one that ideally is part of anintegrated delivery package.

“It's critical credit unions understand the necessity to haveintegration between online banking and bill pay channels,”Leiserson said. “Mobile users are conditioned to expect theexperience to be consistent, and that requires a certain level ofinvestment, so there does tend to be an advantage amongfirst-to-market movers.”

|Having worked for both Digital Insight and CheckFree prior toits 2007 acquisition by Fiserv, Leiserson said he knows some creditunions are more tech-savvy than others. He also knows thatinstitutions seeking to serve the millennial market will havelittle choice but to become more mobile device savvy as well.

|“Millennials will change the way things are,” Leiserson said.“There are more millennials than baby boomers and they havedifferent ways in which they want to transact, and utilizedifferent channels than the average consumer.”

|The desire for multiple billing options shows up in industryresearch as a key factor to strengthening consumer relationships,Leiserson said. Mobile users also appreciate reminders whenpayments are due, as well as a system that helps them increase theorganization of their billing obligations while at the same timereducing the clutter.

|“Millennials, especially, are more likely to pay their billslate, so they need that speed of capability at that mobileprovides,” Lesiserson said. “In credit unions, members dictate whattech they need, but I would suggest that they need this.”

|Credit unions and other financial institutions have a compellingroll to play in introducing and managing mobile bill payapplications for consumers, the analyst added. Since 60% ofconsumers polled admitted that mobile applications would strengthentheir relationship with their financial institution, there hasnever been a more vital time to get into the mobile bill paygame.

|“Does your credit union have mobile bill pay capabilities thatare consistent, optimized and connected to your online bankingprogram?” Leiserson asked. “If you do, how does your systembenchmark against those of other financial institutions? If youdon't have one, get one.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.