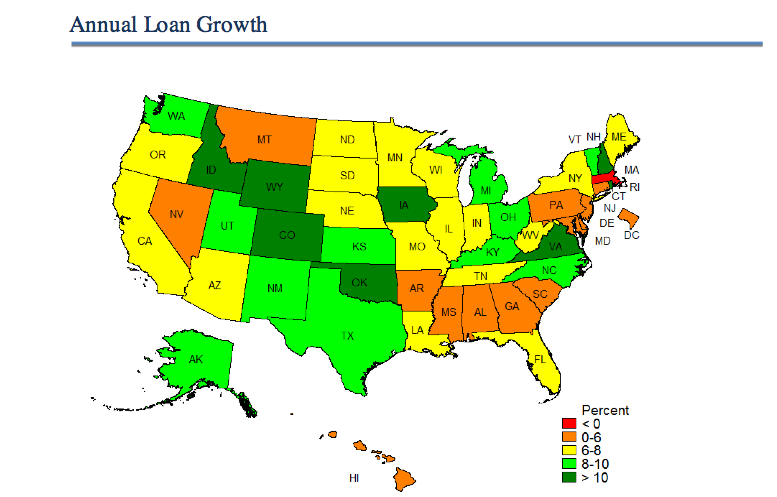

Idaho, Iowa and Virginiaposted the largest gain in loan growth at credit unions in the yearending Dec. 31, 2013, according to the NCUA's Quarterly U.S. MapReview.

Idaho, Iowa and Virginiaposted the largest gain in loan growth at credit unions in the yearending Dec. 31, 2013, according to the NCUA's Quarterly U.S. MapReview.

Idaho also topped the list in the membership, total assets andshares and deposit growth categories.

|“Nationally, total loans outstanding grew 8.0% in the yearending in the fourth quarter of 2013, up from 4.6% the previousyear. Loans grew in all states except Massachusetts, which saw adecline of 0.1%. Idaho (16.7%), followed by Iowa and Virginia (both13.6%), posted the largest gains,” said an NCUA release on Wednesday.

|While membership overall in federally insured credit unionsincreased 2.6% to 96.3 million in 2013, membership grew at a fasterpace in 27 states. Credit unions in Idaho (8.1%) and Virginia(8.0%) saw the fastest membership growth. Membership dropped ineight states including Connecticut, which saw the greatest loss at1.5%.

|Utah had the highest return on average assets with 145 basispoints, and Washington came in second with 116 basis points.

|Federally insured credit unions in Idaho and Iowa had thequickest growth in total assets for 2013.

|“The delinquency rate at federally insured credit unions was1.0% nationally in 2013, a decline from 1.2% the year before.Delaware and New Jersey posted the highest total delinquency rates,while North Dakota and New Hampshire had the lowest,” the NCUA alsosaid.

|Shares and deposits increased 3.7% nationally, with Idahoposting the largest gain. In 2012, shares and deposits rose 6.1%.The NCUA said shares and deposits fell in Massachusetts andMaryland mainly due to the conversion of a large credit union to abank.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.