After experiencing a slightdip in service levels in 2012 brought on in part by the surge innew members from Bank Transfer Day the year before, credit unions are back ontop in a number of areas.

After experiencing a slightdip in service levels in 2012 brought on in part by the surge innew members from Bank Transfer Day the year before, credit unions are back ontop in a number of areas.

(Click on image at left toexpand.)

|According to the American Customer Satisfaction Index released Tuesday, creditunions improved their ACSI score from 82 in 2012 to 85 this year,well ahead of their larger bank competitors.

|The ACSI said it used data from interviews with roughly 70,000customers annually as input to an econometric model for analyzingcustomer satisfaction with more than 230 companies in 43 industriesand 10 economic sectors, as well as more than 100 services,programs and websites of federal agencies.

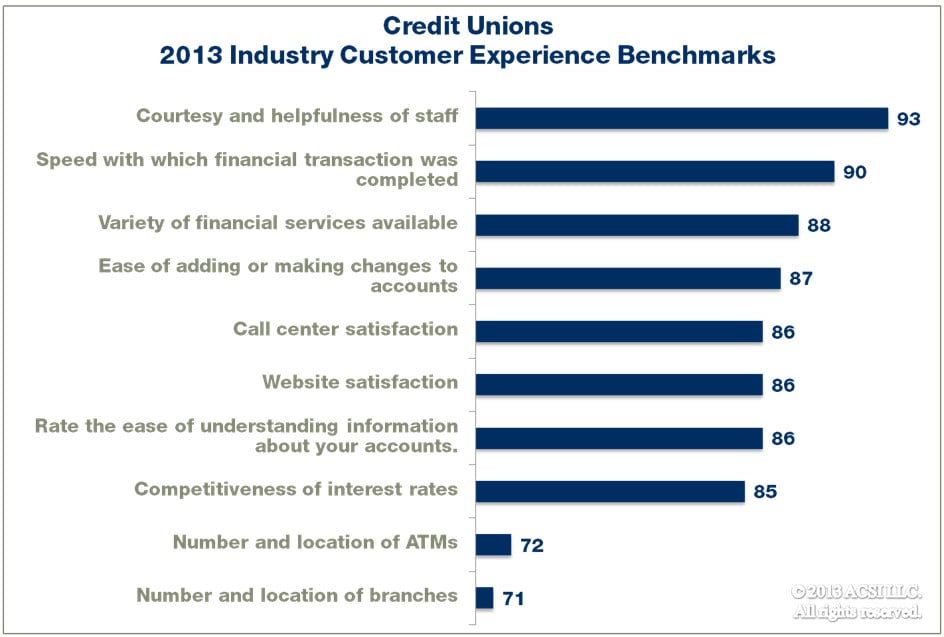

|Credit unions received strong marks for their member service atbranches, the ACSI noted. In addition to having verycourteous and helpful staff, members said transactions were quickerand more efficient compared to banks.

|Almost three-quarters of all credit unions offer free checkingcompared with about one-third of banks and they typically offerlower interest rates on loans and revolving credit, according tothe ACSI. These were major reasons that customer satisfaction withcredit unions climbed 3.7% to an ACSI benchmark of 85, a good dealhigher than for banks, large (73) and small (83).

|Members also touted the wide variety of financial servicesoffered and that accounts were easy to manage and understand,according to the ACSI. Credit unions also do a good job atproviding multi-channel services, with members giving high marks toboth websites and call centers.

|The ACSI also found that unlike bank customers, members are ofthe opinion that their current credit union offers competitiveinterest rates.

|Still, despite all of their benefits, members said the lack ofconvenient ATMs and branches were the most troublesome aspect oftheir service experience at credit unions, according to the ACSI.The report noted that banding together with joint ATM networkaccess is one way that credit unions have been able to fill thisvoid.

|Credit union membership has swelled in recent years, hitting arecord high in 2011, breaking it again a year later and on targetfor another record in 2013, the ACSI pointed out.

|Meanwhile, overall customer satisfaction with retail banking isback to its pre-recession level, the ACSI said. Despite rising bankfees, customer satisfaction for banks grew by 1.3% over the pastyear to an ACSI benchmark of 78, which was up one point from 2012'smark.

|JPMorgan Chase maintained the lead with a 3% gain to 76, whileCitigroup jumped 6% to 74, and Wells Fargo edged up 1% to 72, theindex noted.

|While Bank of America registered its largest improvement in adecade (+5% to 69), it remained in last place, and is the only bankthat has yet to restore its pre-recession level of customersatisfaction, according to the ACSI.

|“Even though banks have raised fees again, the 15th straightyear of such increases, no negative repercussions have beendetected regarding customer satisfaction,” said Claes Fornell, ACSIfounder and chairman.

|He added, “In part, this is because a fair number of consumersare changing their behavior to avoid the fees by exclusively usingtheir own bank's ATMs and maintaining sufficiently large accountbalances.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.