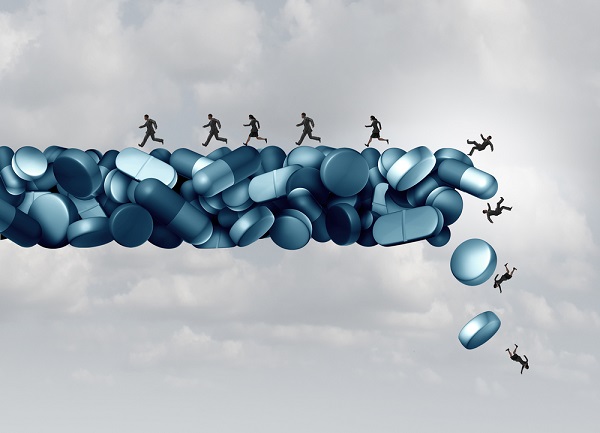

In a desperatebid to save itself, Insys's new managers are trying to sell off itsmain pain drug to a corporate buyer to raise money. (Image: Shutterstock)

In a desperatebid to save itself, Insys's new managers are trying to sell off itsmain pain drug to a corporate buyer to raise money. (Image: Shutterstock)

Sitting in a Boston courtroom in a dark, pinstriped suit, theformer top sales executive at Insys Therapeutics Inc., Alex Burlakoff,listened as federal prosecutors read out crimes he and the companyhad allegedly committed.

|Insys had bribed doctors and their employees withpayments for sham medical events that often turned out to beparties. Physicians who didn't write prescriptions for the company's powerfulopioid were cut off from the company's money. There were lavishdinners, strip-club visits and gun-range outings, all of which ledto booming sales of one of the world's most powerful — anddangerous — pain drugs.

|Related: Doctors receiving kickbacks 14.5 times more likelyto prescribe opioids

|Burlakoff was prepared to plead guilty, his lawyers told thejudge on Nov. 28 — there was even more evidence that prosecutorshadn't listed, they said. He's one of the first drug-companyexecutives charged in the mounting legal backlash to the U.S.opioid crisis, which was tied to about 50,000 deaths last year.Burlakoff faces as many as 20 years in prison, though he has acooperation agreement with the government as other former Insysexecutives go to trial in January.

|The company, meanwhile, could become the first corporatecasualty of the opioid epidemic. Its sales have plunged as itspends millions of dollars on legal defenses of its formerexecutives, including billionaire founder and ex-chief executiveJohn Kapoor.

|In a desperate bid to save itself, Insys's new managers aretrying to sell off its main pain drug to a corporate buyer to raisemoney. They hope to use the proceeds to pivot out of the opioidbusiness into something slightly less controversial – cannabis-derived drugs.

|“We haven't found a buyer — and we might not.”

|Insys's main product is Subsys, a spray version of theultrapowerful opioid fentanyl. When it was introduced in the U.S.in 2012 with a price tag ranging between $3,000 and $16,000 amonth, depending on the dose, it was subject to a tightlycontrolled distribution system. The Food and Drug Administrationallowed the company to market it to cancer patients, to helprelieve their pain.

|It didn't sell well, at least at first. That changed, federalprosecutors have alleged, when Kapoor and other executivesessentially bribed doctors to prescribe it for everything fromchronic pain to back aches, and defrauded insurance providers whowere reluctant to approve prescriptions for off-label use. In somecases, doctors were paid more than $200,000, prosecutors said atthe Nov. 28 hearing where Burlakoff pleaded guilty.

|Business boomed. Subsys sales grew from $8.6 million when itlaunched in March 2012 to $329.5 million in 2015 — making up allbut a sliver of the company's revenue. At the drug's peak in 2015,Insys had a market valuation of more than $2 billion.

|Then in June 2015, a Connecticut nurse pleaded guilty to federalcharges of accepting more than $83,000 in kickbacks from thecompany. There were indictments of doctors, nurses, salesrepresentatives and, eventually, Insys executives. In August, thecompany agreed to a $150 million settlement with the Department ofJustice to resolve a civil and criminal probe, with the potentialfor as much as $75 million more due.

|Sales plunged, as well, falling 80 percent from their 2015 peak.Subsys accounts for more than 95 percent of the company's revenue.The company is short on cash, with $113 million in the bank, andhas said it needs “substantial funds” to stay afloat.

|“There's no guarantee the process will yield any results,” Insysspokesperson Joe McGrath said in an phone interview. “We haven'tfound a buyer — and we might not.” He called the decline in Subsyssales “an over-correction.”

|

Now Insys is trying to find a new line of business by becoming a“cannabinoid pioneer,” said McGrath. It's one of the hottest areasin medicine, and investors have flocked to tiny companies promisingto win the race for a new class of marijuana-derived therapies.

|Insys already produces one of a few drugs approved by the Foodand Drug Administration made from synthetic cannabinoids,marijuana-inspired compounds that have become promising treatmentsfor an array of medical conditions. Insys's drug, Syndros, treatsloss of appetite in people with AIDS and nausea caused bychemotherapy.

|It's a meager commercial product, bringing in only $976,000 inthe third quarter, according to a company filing. The company isdeveloping more cannabidiol, or CBD, drugs for infantile spasms,childhood absence epilepsy and a rare genetic disorder calledPrader-Willi syndrome. It's also developing an overdose-reversalproduct that uses naloxone, a powerful anti-opioid medicine.

|“This pivot may be forced, but CBD and opioid dependence are hotspaces with a lot of interest from investors,” said Curt Wanek, apharmaceutical equity analyst for Bloomberg Intelligence. “It'llcost money to bring these drugs to market, but all it takes ispositive data” to raise more funding, Wanek said. The company hassaid it anticipates spending heavily to bring the products tomarket.

|Time running out

Insys is also paying for the legal-defense costs of itsexecutives under an agreement, common at many large companies, thatforces it to cover any investigation, defense, settlement orappeal-related expenses. Kapoor is scheduled to face criminal trialin Boston federal court along with other executives in January,where Burlakoff is expected to be a star witness. Kapoor's defensehas cost the company more than $28 million in indemnification feesthrough the 12 months through Sept. 30.

|A third-quarter filing with the Securities and ExchangeCommission said that Insys's existing and future legal insurancecoverage may be inadequate. In some cases, it “may not have anyinsurance coverage at all and which may entail settlement paymentsor litigation judgments that could individually, or in theaggregate, have a materially adverse effect on our financialcondition and results of operations.”

|“New management is figuring out a way to rationalize andminimalize the legal costs,” said McGrath, who said the company isdisputing the indemnification fees. “It's an unsustainabletrajectory.”

|Insys isn't alone in facing opioid-related legal issues.Hundreds of cases have been filed against pharmaceutical companiesand distributors. But no company's troubles may be more acute thanInsys's.

|“They're fighting a losing battle,” said Robert Valuck, aprofessor of pharmacy at the University of Colorado AnschutzMedical Campus and director of the Colorado Consortium forPrescription Drug Abuse Prevention, which works with lawmakers toaddress the opioid crisis. “Whether they keep trying to defend orsell Subsys, there's going to be some amount of perception thatthis is the product that got them sued.”

|More updates on the opioidepidemic:

- Florida AG targets Walgreens, CVS in amended opioidlawsuit

- The tech industry wades into the fight againstopioid abuse

- There's a new, more powerful opioid on themarket

Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.