A smaller window toraise drug prices could lead drugmakers to look for other ways togenerate growth, including M&A deals. (Photo:Shutterstock)

A smaller window toraise drug prices could lead drugmakers to look for other ways togenerate growth, including M&A deals. (Photo:Shutterstock)

Washington wants drug prices to fall. Wall Street wants stock prices to rise. For some of the world'slargest pharmaceutical companies, pleasing both sidescould be a problem.

|Last year, the industry promised restraint after PresidentDonald Trump took aim at rising pharmaceutical costs. OnJan. 1, drugmakers returned to their annual practice of regularincreases, boosting prices for dozens of treatments, fromhot-selling arthritis therapies to painkillers at the center of theU.S. opioid epidemic.

|Related: Quick take: Key themes affecting pharma in2019

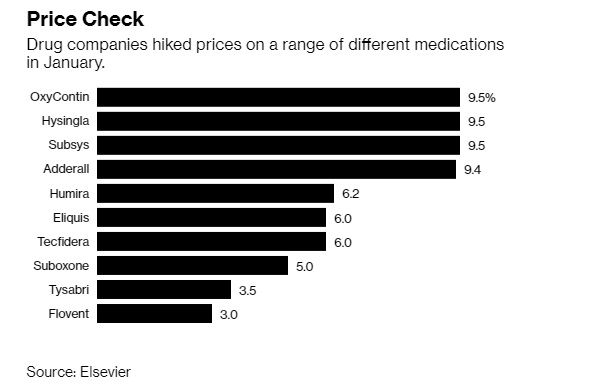

|Hundreds of drugs saw price increases from Dec. 31 to Jan. 2,according to Elsevier, a health-information analytics company. Theaverage increase was 6.7 percent, according to a Bloomberg analysisof the data.

|Many of the increases were lower than past hikes, a reflectionof ongoing pressure from the White House, Congress andhealth-insurance companies. That pressure could make it harder fordrugmakers to keep aging blockbusters growing while developing newproducts.

|“What investors don't yet understand is how reliant companiesare on price increases for revenue growth,” said Geoffrey Porges,an analyst at Leerink Partners who wrote a report in Octoberlooking at how much price increases have propped up drugmakers'results.

|Overall, Porges found that nearly two-thirds of the sales growthfrom the 45 bestselling drugs in the U.S. was attributable to priceincreases between 2014 and 2017.

|A smaller window to raise prices could lead drugmakers to lookfor other ways to generate growth, including M&A deals. OnThursday, Celgene Corp., which has steadily increased the price ofblockbuster blood-cancer treatment Revlimid, agreed to be bought byBristol-Myers Squibb Co. for $74 billion. Bristol increased pricesfor several drugs this week, including arthritis treatment Orenciaand leukemia therapy Sprycel.

| A case in point is Biogen Inc., aCambridge, Massachusetts-based biotechnology company whosemultiple-sclerosis drug Tysabri is one of the leading treatmentsfor the disease. It has generated more than $1 billion in annualsales since 2011, but recently all of that growth has come fromprice increases, not from more patients taking the drug, accordingto Porges.

A case in point is Biogen Inc., aCambridge, Massachusetts-based biotechnology company whosemultiple-sclerosis drug Tysabri is one of the leading treatmentsfor the disease. It has generated more than $1 billion in annualsales since 2011, but recently all of that growth has come fromprice increases, not from more patients taking the drug, accordingto Porges.

Biogen raised the price of Tysabri on Jan. 1. by 3.5 percent, inline with the increase it took last year, to $6,396.30 for the mostcommon dose. It also boosted prices for three othermultiple-sclerosis drugs, including Tecfidera, which had thelargest increase of the group at 6 percent.

|In an emailed statement, Biogen spokesman David Caouette saidthe net price increase of the four drugs was below 2 percent andshort of the overall rate of inflation, which rose 2.2 percent inNovember in annual terms, according to the Labor Department'sconsumer-price index.

|“We are committed to providing patients with affordable accessto our medicines; we must also preserve our ability to invest inthe next generation of therapies and cures for MS and otherneurological diseases,” Caouette said. He declined to comment onLeerink's findings.

|Biogen isn't alone. AbbVie Inc. raised the price of Humira by6.2 percent to $5,174.09 on Jan. 1 for the most commonly prescribeddosage, according to Elsevier. The world's bestselling drug, Humirais expected to bring in $19.6 billion in sales over the next 12months. The Leerink analysis found that about 40 percent of thedrug's revenue growth since 2014 was due to price hikes.

|“AbbVie carefully evaluates the pricing of its medicines,” saidspokeswoman Adelle Infante in a statement, adding that for 2019 thecompany is committed to no more than one single-digit percentageprice increase, “which will be further offset by rebates anddiscounts.”

|Painkiller prices

Drugmakers facing legal problems linked to the U.S. opioidepidemic also boosted the prices of their medications in recentdays. Closely held Purdue Pharma Inc., which produces thepainkiller Oxycontin, and Insys Therapeutics Inc., maker of acontroversial fentanyl painkiller for cancer patients, eachincreased the wholesale cost of their main drugs by 9.5percent.

|Representatives for Purdue and Insys didn't return requests forcomment.

|Many opioid manufacturers are paying costly fees to coverinvestigation, defense, settlement or appeal-related expenses.Insys founder and former chief executive John Kapoor is scheduledto face criminal trial in Boston federal court along with otherexecutives this month. He has plead not guilty to bribing doctorsto prescribe Subsys.

|Subsys accounts for nearly all of the company's revenue, whichhas fallen 80 percent from its peak in 2015. Kapoor's defense alonehas cost the company more than $28 million in indemnification feesin the 12 months through Sept. 30, according to a company filingwith the Securities and Exchange Commission.

|Political noise

Pharmaceutical stocks were relative standouts in what was agenerally terrible year for the market last year, with heavyweightssuch as Pfizer Inc. and Merck & Co. among the strongestgainers.

|Pfizer was the most prominent company caught up in the battleover drug prices in 2018. In July, Trump singled it out for raisingprices on more than 40 drugs, causing the company to hold off. Itthen said in November it would resume raising prices inmid-January, though by less than earlier planned.

|A representative for Pfizer declined to comment.

|“The political noise has put a lot of pressure on any individualprice hike,” especially those that exceed 10 percent, said BrianRye, a senior government analyst at Bloomberg Intelligence.

|Despite worry that the mood in Washington could translate intobig changes to old practices, drugmakers are being encouraged toride out the political blowback from raising prices if it helpsthem meet their financial goals.

|“We've been talking to people on the policy side that areworking with companies,” said Christopher Raymond, seniorbiotechnology analyst at Piper Jaffray & Co. “Their advice hasbeen that you might get a tweet here and there but if you canhandle the heat, go ahead and do it.”

|Read more:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.