While the focus of open MEPs policyinitiatives is on small- and medium-sized employers – driving downthe cost and administrative burden – the real beneficiaries areAmerican workers, particularly minorities. (Photo:Shutterstock)

While the focus of open MEPs policyinitiatives is on small- and medium-sized employers – driving downthe cost and administrative burden – the real beneficiaries areAmerican workers, particularly minorities. (Photo:Shutterstock)

Over the past few years, we've written extensively aboutauto-portability — what it is, how it works and the significant,positive impact it will have on the retirement security of workingAmericans. Our positions have been supported by research,predictive models (including EBRI's RSPM) and real-world resultsfrom the initial implementation of auto-portability.

|In this article, we address an important retirement publicpolicy question: How would a pairing of auto-portability with openmultiple employer plans impact the retirement savings of America'sminorities, particularly African-Americans?

|Our findings, presented at WISER's Annual Symposium on September26th, reveal that Open MEPs alone can serve as an importantcatalyst to increasing minority and African-American planparticipation levels, over a generation of savers. However,when Open MEPs are paired with auto-portability, the result is adramatic, incremental increase in the preservation of minorities'retirement wealth.

|Minority access and wealth preservation in DC plans

Today, minorities face two fundamental challenges inaccumulating retirement wealth: 1) gaining access to anemployer-sponsored retirement savings plan and 2) preserving theirretirement savings as they change jobs.

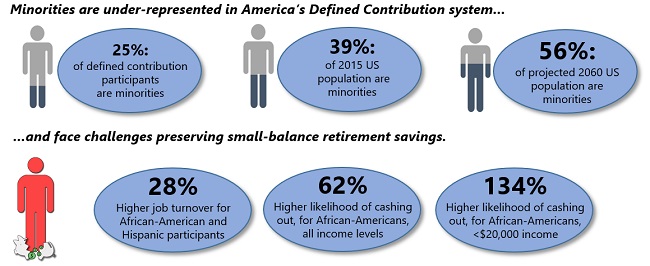

|Minorities are under-represented in America's definedcontribution system, representing about 25% of all definedcontribution participants, while accounting for 39% of the generalpopulation. By 2060, the U.S. Census Bureau's NationalPopulation Survey projects that minorities will represent 56% ofthe general population.

|As plan participants, minorities lag in retirement wealthaccumulation, and tend to have lower balances, lower deferral ratesand higher rates of hardship withdrawals. (See Figure 1below.) Finally, minority participants have higher rates ofjob turnover and experience considerably higher levels of cashoutsfollowing a job change, including:

- 28% higher job turnover, for African-American and Hispanicparticipants

- 62% higher likelihood of cashing out, for African-Americans,all income levels

- 134% higher likelihood of cashing out, for African-Americans,with less than $20,000 income

Figure 1: Minorities anddefined contribution plans. (Sources: EBRI, US Census Bureau andAriel/Aon Hewitt, via Retirement Clearinghouse)

Figure 1: Minorities anddefined contribution plans. (Sources: EBRI, US Census Bureau andAriel/Aon Hewitt, via Retirement Clearinghouse)

Open MEPs policy initiatives

In 2012, the Department of Labor issued Advisory Opinion2012-04A, which effectively inhibited the creation of openmultiple-employer plans. Since 2013, there have been at least10 proposals from Congress or the Executive branch that would relaxrestrictions around open MEPs.

|Most recently, three public policy initiatives have emerged tofacilitate their widespread adoption, including:

- An Executive Order, issued 8/31/18, instructing the Departmentof Labor and the Secretary of the Treasury to propose amendments toregulations or guidance.

- The Family Savings Act of 2018, one of three bills comprising“Tax Reform 2.0.”

- The Retirement Enhancement and Savings Act (RESA): Unanimously approved by the Senate Finance Committee in 2016 andreintroduced in 2018, RESA includes language on open MEPs verysimilar to the Family Savings Act of 2018.

While the focus of Open MEPs policy initiatives is on small- andmedium-sized employers – driving down the cost and administrativeburden of sponsoring defined contribution plans – the realbeneficiaries are American workers. Minorities shoulddisproportionately benefit from the adoption of Open MEPs since,according to Small Business Administration (SBA) statistics, racialand ethnic minorities represent over 37% of total small businessemployment.

|A predictive model of Open MEPs and auto-portability

To understand the potential impact of Open MEPs onminorities, we utilized the Auto Portability Simulation model(APS), a discrete event simulation model to predict the effectsover a generation of minority savers, including Open MEPs scenariosboth with and without auto-portability, and under two balancethresholds.

|The impact of Open MEPs on minorityparticipation:

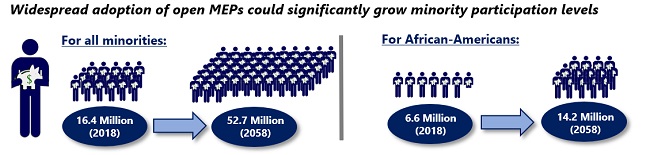

|The APS model assumes that Open MEPs produce a rapid growth inparticipation in small (1-99 employees) and medium-sized (100-249employees) businesses during the period 2019-2022, where 16.7million additional, active participants are added to the definedcontribution system.

|This initial, rapid growth serves as a stimulus to graduallyincrease minority participation levels over time, eventuallymirroring the underlying population by the end of the simulationtimeframe, in 2058.

|Under these assumptions, overall minority participation wouldincrease from 16.4 million in 2018, to 52.7 million in 2058. The number of African-American participants would increase from 6.6million to 14.2 million. (See Figure 2 below.)

| Figure 2: Potential growthof minority DC plan participation / expanded access (Source: AutoPortability Simulation: Infographic, RetirementClearinghouse)

Figure 2: Potential growthof minority DC plan participation / expanded access (Source: AutoPortability Simulation: Infographic, RetirementClearinghouse)

The effects of Open MEPs on minorities' retirementsavings:

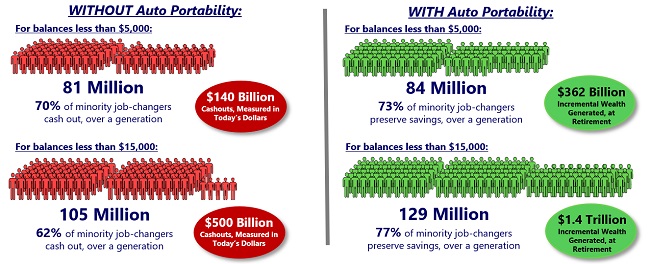

|The APS then examines what happens to two segments of minorityjob-changers – those with balances under $5,000 and those withbalances under $15,000.

|Without auto-portability, minority job-changers with balancesless than $5,000 cash out 70% of the time, totaling $140 billion,in today's dollars. Those with balances below $15,000 fare nobetter, with 105 million cashouts totaling $500 billion.

|By contrast, with auto-portability, 84 million – 73% of minorityjob-changers with balances less than $5,000 – will preserve theirretirement savings, incrementally accumulating $362 billion inretirement wealth. (See Figure 3 below.) If the threshold isincreased to $15,000, the numbers increase to 129 millionjob-changers (77%), with $1.4 trillion in retirement wealthpreserved.

| Figure 3: Results of autoportability simulation: Minority savers by balance segment (Source:Auto Portability Simulation: Infographic, RetirementClearinghouse)

Figure 3: Results of autoportability simulation: Minority savers by balance segment (Source:Auto Portability Simulation: Infographic, RetirementClearinghouse)

While our simulation model predicts that expanded accessinitiatives, such as Open MEPs, can play an important role inincreasing minority and African-American participation in definedcontribution plans, it also indicates they could fall short inpreserving their retirement wealth.

|However, when paired with auto-portability, the combination ofincreased participation with savings preservation produces dramaticincreases in minorities' retirement wealth.

|These results have important retirement public policyimplications. To increase retirement security for all Americans —including minorities and African-Americans – it will be vitallyimportant to pair expanded access with auto-portability.

|Spencer Williams is Founder, President and CEOof Retirement Clearinghouse.

|Tom Hawkins is Senior Vice President ofMarketing & Research at Retirement Clearinghouse.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.