Pot stocks have been soaring amidCanada's pending legalization of recreational cannabis on Oct. 17.(Photo: Shutterstock)

Pot stocks have been soaring amidCanada's pending legalization of recreational cannabis on Oct. 17.(Photo: Shutterstock)

(Bloomberg) –U.S. investors are piling into an exchange-traded fund that tracks the Canadianpot industry as the country moves toward legalization and liquorproducers show growing interest in selling pot.

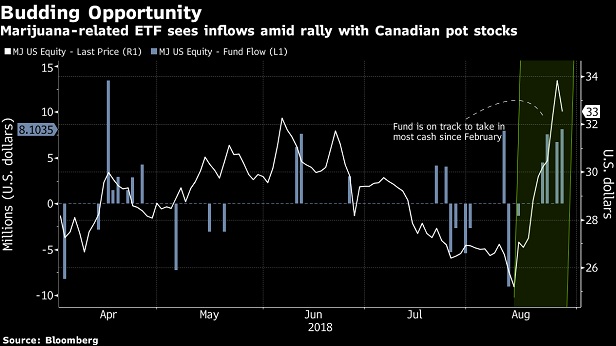

|The U.S.-listed $436 million ETFMG Alternative Harvest ETF,known by its ticker MJ, has taken in about $22 million in August,putting it on track for the largest monthly inflow since February.That asset growth has been fueled by a 35 percent surge in thefund's price since Aug. 14.

|Related: Vanguard health-care ETF sees recordtrading as Big Pharma soars

|Pot stocks have been soaring amid Canada's pending legalizationof recreational cannabis on Oct. 17 and growing speculation thatother industries will buy in. For example, Tilray Inc., a Canadianmarijuana pharmaceutical maker, has more than tripled since itstarted trading on July 18.

| (Chart: Bloomberg)

(Chart: Bloomberg)

A major boost for cannabis shares came two weeks ago, whenalcohol giant Constellation Brands Inc. invested $3.8 billion inCanadian marijuana maker Canopy Growth Corp., the biggest deal yetin the burgeoning industry. Since the move was announced on Aug.15, the BI Canada Cannabis Competitive Peers index has gained morethan 30 percent, including 3.7 percent Wednesday.

|Related: Look out world, your artificialintelligence ETF is here

|“This reinforces the interest among large consumer companies inpartnering with cannabis producers,” said Bloomberg Intelligenceanalyst Kenneth Shea. “It also signifies the confidence thatconsumer companies have for the continued rise in consumer demandfor legal cannabis-infused beverages in Canada, but also eventuallyin the U.S. and in international markets.”

|Related: Japan might not dominate Olympics but inETFs it takes gold

|Last week, BNN Bloomberg TV reported that the global liquor giant DiageoPlc is seeking a cannabis partner, raising market speculation overwho that may be. Molson Coors Canada Inc. also announced a jointventure with Hydropothecary Corp. to develop non-alcoholic,cannabis-infused beverages.

|However, while the U.S.-listed fund is going strong, aCanada-listed counterpart is struggling. The $703 billion HorizonsMarijuana Life Sciences Index ETF, ticker HMMJ, is on track for itsbiggest month of outflows since it began trading in April 2017,with $6.1 million leaving the fund this month, including $5.1million on Tuesday alone.

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.