What's $300 billion between friends?

|Reuters reports that a new actuarial study by Milliman has takenanother look at the funding status of America's 100 largest publicpension plans, and earlier estimates likely understated theunfunded status by at least $300 billion.

|All totaled, Milliman suggests, the deficit is probably closerto $1.2 trillion. The earlier numbers, the firm says, were based ona median funding level of 75.1 percent; Milliman's more forensiclook at the numbers, using different standards to gauge liabilitiesand assets, puts the median funded level at 67.8 percent.

|Oddly, Milliman researcher Rebeccar Sielman, author of thereport, said that huge difference was in fact a piece of good news,as it at least demonstrates that America's major public pensionsystems are being truthful about their financial standings - bothgood and bad.

|Most of the 100 funds tracked by Milliman had set their medianrate of return on investments at 8 percent but more recent,post-meltdown years have reduced that to about 3.2 percent per yearfor the last five years.

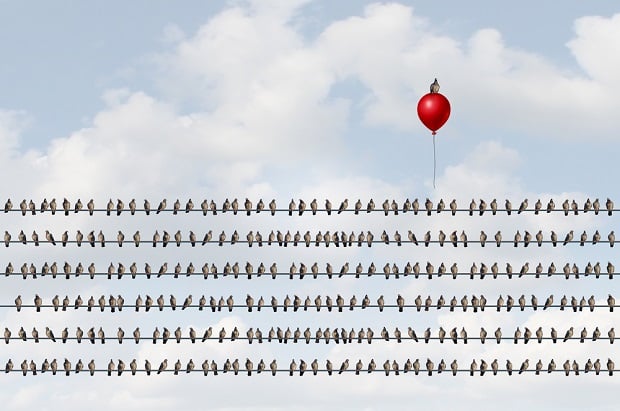

|According to Reuters, that has fostered a climate where manypension funds are more frequently underreporting their unfundedliabilities, and political critics across the nation have suggestedthe funds drop their assumed rate of return to a more realistic 5percent - which could have drastic effects on the unfundedliabilities and the plans' ability to pay benefits in thefuture.

|Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.