WASHINGTON (AP) — President Barack Obama's proposal to impose a "Buffett rule" tax on the rich is generating enormous political wattage, but the plan itself would directly affect only a tiny fraction of Americans.

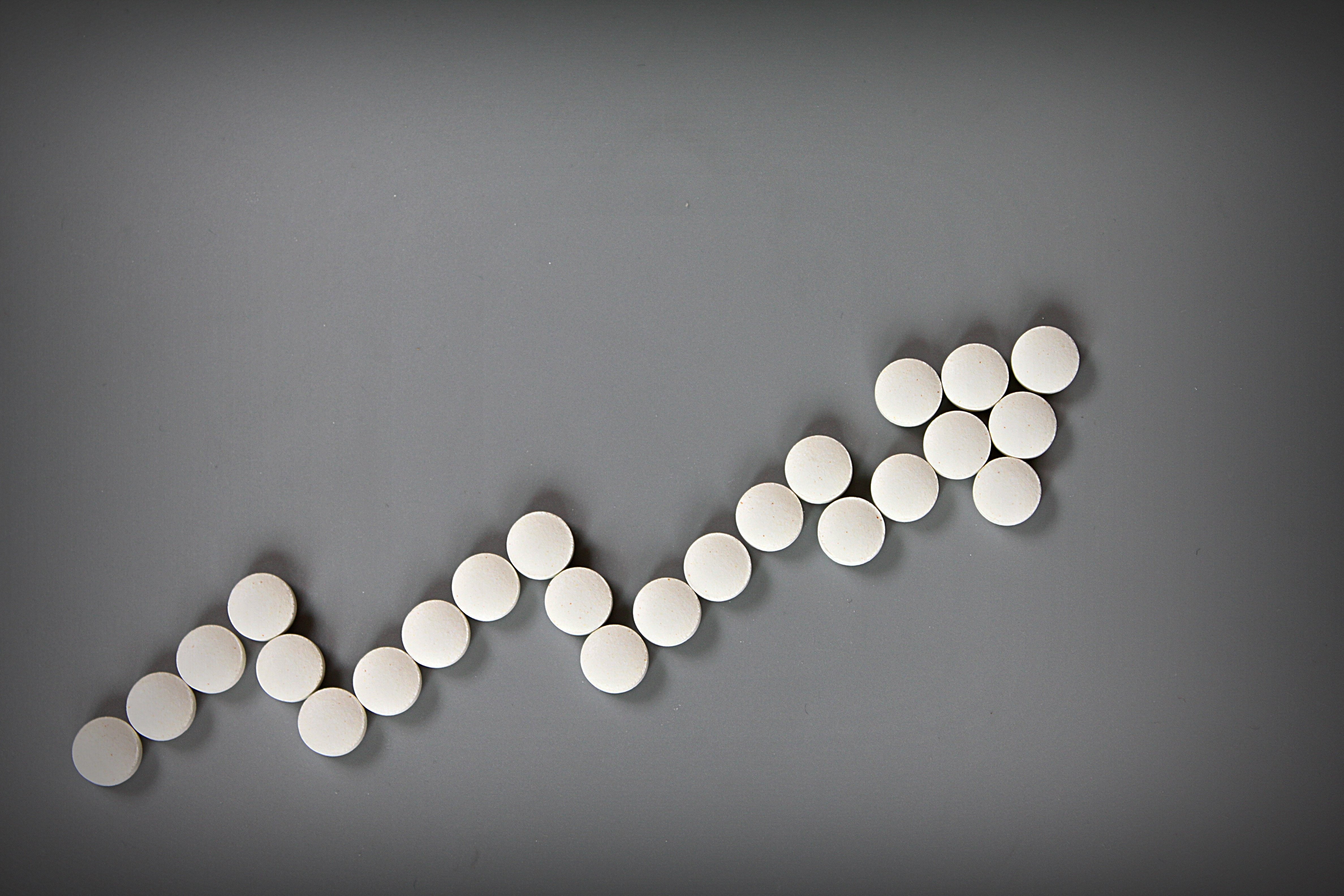

Only around 210,000 taxpayers — a bit over 1 of every 1,000 — would face higher federal taxes if the measure were enacted, according to an estimate by one respected bipartisan research group.

In addition, while Republicans say the plan would be a job killer, only a small proportion of businesses would potentially be subject to the tax, according to data from a 2011 Treasury Department study. These firms make disproportionately large amounts of money, but many of them don't employ any workers.

Republicans, calling the Buffett rule a political sideshow designed to distract voters from the economy's problems, seem certain to round up enough votes to block the bill when the Democratic-run Senate votes on it Monday. But Democrats are eager to hold repeated votes on it this election year to demonstrate that they favor economic equality while Republicans prefer coddling the wealthy, so it's unlikely to disappear soon.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.