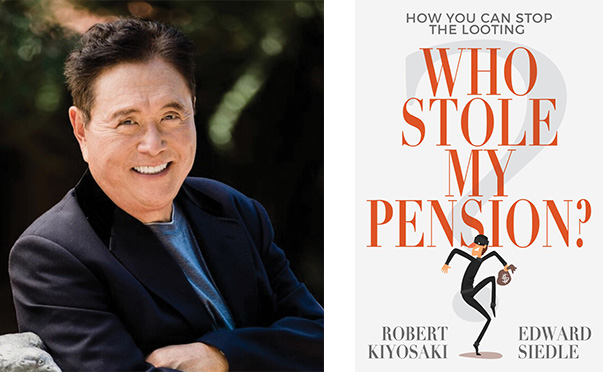

Robert Kiyosaki.

Robert Kiyosaki.

Robert Kiyosaki, controversial bestselling author of "Rich Dad Poor Dad," has an urgent message foremployees: Wall Street is gambling with your pensions. They're rifewith risky, secretive investments and scandalously high fees, andthey dispense deceptive performance results. Because of thispension crisis, the next market crash will wipe you out.

|In an interview with ThinkAdvisor, Kiyosaki discusses his new book,"Who Stole My Pension?: How to Stop the Looting"(Plata Publishing, Jan. 14, 2020), written with Edward Siedle, aformer Securities and Exchange Commission (SEC) attorney.

|In the interview, Kiyosaki, 73—who is as outspoken and blunt inconversation as in writing—calls Wall Street "corrupt" and theFederal Reserve "a criminal organization." He says pensions "lie"about their returns and participants are oblivious to thespeculative investments and fleecing. He himself proudly steersclear of the stock market, investing instead in the shadow bankingsystem because, he says, "that's where the money is."

|The entrepreneur owns rental properties, as well as hotels, golfcourses, and oil wells, among other businesses. He got rich chieflyby licensing his "Rich Dad Poor Dad" brand to franchisees andinvesting in real estate. He has authored 28 personal financebooks, and he wrote two others with his friend President DonaldTrump.

|The way Kiyosaki tells it, he was mentored—starting at agenine—by his best friend's self-made affluent-but-uneducated "richdad" on how to make money, while his own biological "poor dad,"with a Ph.D., opted for financial security via a government job. Helater lost his pension and was left without financial resources.Some reports, however, state that Kiyosaki's "rich dad"—who builtwealth in the construction business, Kiyosaki says in theinterview—was fictional.

|The author grew up in Hawaii and founded the Rich Dad Co., basedin Scottsdale, Arizona, in 1996. He reportedly filed for corporatebankruptcy in 2012 because of a multimillion-dollar lawsuit broughtby The Learning Annex against another of his companies, RichGlobal. Further, some of his seminar franchisees have been chargedwith perpetrating investment scams.

|ThinkAdvisor recently interviewed Kiyosaki, speaking by phonefrom his home office in Phoenix. He contends that pensions areinvested in "financial weapons of mass destruction," like those"that brought down the market in 2008. … Nothing has changed." In"Who Stole My Pension?" Kiyosaki and Siedle, who has forensicallyinvestigated more than $1 trillion in retirement plans, urgepension participants to create "a global network" to "improvepension investment practices."

|Here are excerpts from our interview:

||

ThinkAdvisor: Why did you write a bookabout what you see as a pension crisis?

|Robert Kiyosaki: To give people a chance totake action and prepare before the house of cards comes down again.I'm afraid that the crash that's coming will make 2008 look likenothing. Student loan debt is now bigger than the subprime marketdebt, which brought down the market in 2008.

||

TA: You and your co-writer, Edward Siedle,say: "Pensions are lying about their investment performance, andyou should be suspicious about the results they tell you." Pleaseexplain.

|RK: Pensions have been stolen by thesame people that brought you the subprime real estate crash.

||

TA: Siedle writes: "Firms, in recent years,have devised the most secretive investments in history—schemesdesigned to conceal outrageous fees, risks, unethical, and evenillegal practices to thwart pension transparency." Pleaseelaborate.

|RK: Wall Street takes teacher andfirefighter union members to Vegas or Hawaii, and they party on.They get them drunk and tell them about derivative-type investments[like the ones] that brought down the market in 2008. "Financialweapons of mass destruction" is what Warren Buffett called them. Heshould know because his company, Moody's, insured thosederivatives. So Buffett's hands aren't clean, either. But he knowswhat he's talking about. [Buffett's Berkshire Hathaway is thelargest shareholder of Moody's Corp., with a 13 percent stake.]

||

TA: Back to investment info given to unionmembers: What's their response?

|RK: They have no idea what [thefirms] are talking about. So they're put into extremely risky,exotic things with high fees, the same things the subprime guyswere doing 2005 to 2007.

||

TA: So you're saying that this isn't a newscenario?

|RK: Nothing has really changed. TheFederal Reserve Bank is a criminal organization that bailed out thebanks—the guys who rip us off. The Fed lowered the interest rate toalmost zero so that the pension plans can't get any returns. Ifyou're expecting a 7 percent return, the best you can get is 2percent. The pensions are going broke. In Paris and Chile, peopleare rioting, and it's all about pensions. But Americans don't talkabout [a U.S. pension crisis].

||

TA: You worked with your friend DonaldTrump for eight years co-writing two books. Is he aware of thepension crisis that you warn about?

|RK: He knows it's coming.

||

TA: But it's doubtful that he's doinganything about it. Why is that?

|RK: Because Grunch—Gross UniversalCash Heist [from Buckminster Fuller's book, "Grunch of Giants"]—controls everything: thepeople at the Federal Reserve Bank, like Goldman Sachs and WellsFargo.

||

TA: You say you forecasted the crash ofLehman Bros. six months before the start of the Great Recession of2008. What led you to that call?

|RK: In Hawaii, where I grew up, therewere always earthquakes before a [volcanic] eruption. The shakingwould increase as it got closer and closer. So there were alwayswarnings. The same with Lehman Bros.

||

TA: Did you go public with yourprediction?

|RK: Yes. [At the beginning of] 2008,I went on CNN and warned that the crash was coming. Wolf Blitzersaid, "Are you saying that Lehman Bros. is closing down?" I said,"Yes." I was never invited back because they don't want peoplescaring the public. They have to protect the banks and financialplanners.

|…

|TA: America is in a depression, you argue.At this very moment?

|RK: Yep. Everybody is happy becausethe stock market is at an all-time high, but they're not watchingthe repo market [repurchase agreement loans] or the [chieflyunregulated] shadow banking system. The corporate credit debt market is where theproblem lies.

||

TA: Please explain.

|RK: The stock market is high becausecorporations like GE, Ford, General Motors, AT&T, and Dell areborrowing trillions of dollars and buying back their stock. Those companies' bondshave been downgraded from AAA to BBB, one level above junk. If weraise interest rates 2 percent, the whole economy will collapsebecause we can't pay for the debt. That's why they keep loweringinterest rates.

||

TA: What's your forecast for the stockmarket, then?

|RK: It's going to stay up till Trumpgets re-elected—if he gets re-elected. But if it crashes, thenBernie [Sanders] wins.

||

TA: How do you invest in themarket?

|RK: I don't invest in the stockmarket. There are a million doors to heaven but a billion doors tofinancial hell. I don't have a 401(k), an IRA, or stocks. I havelots of real estate: 7,000 rental units. So every month 7,000people send me a check.

||

TA: You invest in the shadow bankingsystem, even though you write, "It was the shadow banking system,not subprime real mortgages, that nearly collapsed theworld economy." Why do you invest there?

|RK: That's where the money is. Idon't trust Wall Street and the stock market. It's 100 percentmanipulated by Grunch. It's corrupt, just like the Federal Reserve.They bailed out Wall Street with taxpayer money. Now the shadowbanking system has started to wobble, and the Fed is bailing it outwith the repo market.

||

TA: Why do you take issue with thewidespread advice: "Invest for the long term for a well-diversifiedportfolio of stocks, bonds, mutual funds, and ETFs"?

|RK: It puts people in a hypnotictrance. You think: 'I'll do that, and I'll be safe." It gives thema false sense of security, while the bankers, the Fed, and theTreasury are ripping off everyone. The Fed causes crises. They bailed out guys likeGoldman Sachs who profited from the [2008-2009] financial crisis.Meanwhile, mom and pop got wiped out.

||

TA: So you think investing for the longterm is bad advice?

|RK: When I was a kid, long-terminvesting worked. But today, with high-frequency trading, you tradeagainst a computer, which can do, like, a million trades in asecond—whereas you might do one trade in a day. The professionalsget out of the market before mom and pop even know what happened.Investing in the stock market for the long term works when themarket is going up. But I'm afraid we're at the top right now.

||

TA: Do you have a pension?

|RK: No. I didn't need a pensionbecause I had a financial education from my rich dad. Our wholefamily [biological dad's family] were schoolteachers in Japan. Whatthey valued most was their pensions. I had relatives who had asmany as three pensions. My poor dad wanted me to follow in hisfootsteps and become a schoolteacher.

||

TA: How did you react to thatidea?

|RK: I had been a Marine pilot inVietnam. When I came back, my father said, "You're unemployed. Getyour Master's and Ph.D. and go to work for the government." I said,"Hell no!"

||

TA: Why?

|RK: My poor dad had a Ph.D., but whenhe lost his pension, he was a poor man. He didn't know what todo.

||

TA: Why did he lose his pension?

|RK: He resigned from the governor'soffice and ran for lieutenant governor of the state of Hawaii as aRepublican, and he lost his paycheck and his pension. His boss, whohe ran against, was a Democrat and the chief of police. The head ofthe crime syndicate was also a police officer. My father was luckythey didn't kill him.

||

TA: What did he say about your book, "RichDad Poor Dad"?

|RK: I had to wait till after he diedto write it. My family went nuts. They're Japanese: "Youdisrespected the father!"

||

TA: You say your rich dad showed you how tobuild wealth—and that's what you've done. Do you livelavishly?

|RK: I have more money than I'll everuse. I didn't follow the mantra: Go to school, work hard, makemoney, get out of debt, and invest in the stock market. I just playreal-life "Monopoly"!

||

From: ThinkAdvisor

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical Treasury & Risk information including in-depth analysis of treasury and finance best practices, case studies with corporate innovators, informative newsletters, educational webcasts and videos, and resources from industry leaders.

- Exclusive discounts on ALM and Treasury & Risk events.

- Access to other award-winning ALM websites including PropertyCasualty360.com and Law.com.

*May exclude premium content

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.