Calum Weaver, executive managing director of Cushman & Wakefield’s capital markets division in South Florid and the leader of its multifamily investment properties team

Calum Weaver, executive managing director of Cushman & Wakefield’s capital markets division in South Florid and the leader of its multifamily investment properties team

MIAMI—While some segments of the multifamily market in South Florida are tightening, a host of positive demographic influences, including strong demand and population growth, will lead to another strong year for this sector.

Calum Weaver, executive managing director of Cushman & Wakefield’s capital markets division in South Florida and the leader of its multifamily investment properties team, says the multifamily market is maturing from its “dizzy upward trajectory” that has led to nine straight years of record rents and low vacancies.

Weaver, in his South Florida Multifamily 2019 Forecast report, stated that the near decade of strong performance is not setting up the multifamily sector in South Florida for another crash.

“The South Florida multifamily fundamentals are and will continue to remain strong,’ Weaver said, “Population/household growth, lower homeownership rates, higher home prices, demographic preferences to rent versus buy, the low unemployment rate, wage growth starting to improve, all contribute towards an extremely healthy market that will continue throughout 2019.”

In the past five years, the population in South Florida has grown by 431,000 (7.2%), while 47,3365 new apartment units have been built, clearly not enough new supply to meet demand.

Cushman & Wakefield in the report notes that in the next five years, South Florida is expected to enjoy a positive net migration of 7.6% or 476,000 new residents. The region would need to build more than 52,300 units during that time to keep pace with the population growth. At present, the pipeline of new units to be built and delivered by 2022 in South Florida totals just 20,971.

While he expects a strong year for multifamily, he did note that the rate of growth experienced over the last decade has slowed, which he believes is a positive for the market.

“More investors are having a longer-term investment perspective of 7 to 10 years and securing debt accordingly,” he states in the report. “Investors are seeking cash-on-cash returns in the 6% to 8% range with IRRs from 9% to 15% depending on asset quality.”

He notes that this maturing market and the sensible investment strategies now being employed “means the South Florida ‘boom-bust’ history is a thing of the past—or at least not something that will happen in the near future.”

Weaver believes the only real viable potential headwind for the South Florida multifamily market is rising interest rates. Rising rates in late 2018 caused some multifamily investors to be skittish. However, those concerns have since subsided, he noted. Weaver predicts rates will continue to rise marginally and expects mortgage rates to rise 25 basis points in the second half of 2019.

Some of the other trends Weaver expects to see in 2019 are continued investment interest in opportunity zones, capital investment in Class B or C properties for workforce housing that can lead to higher rents for building owners, and multifamily growth in submarkets such as Allapattah (Miami) and Fort Lauderdale’s urban core for example. He also believes that storied Miami Beach is another submarket poised for growth in the years to come.

Source: Cushman & Wakefield

Source: Cushman & Wakefield

Some of the key takeaways from the report included:

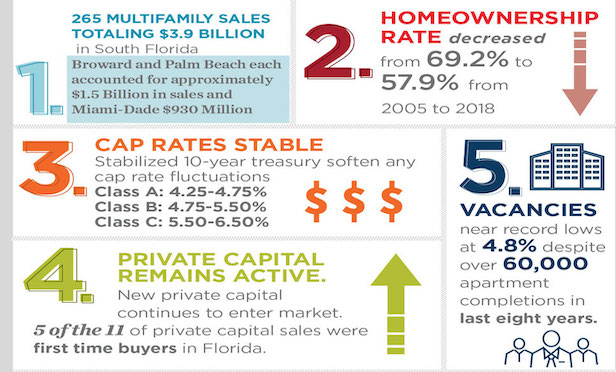

South Florida had 265 multifamily sales in 2018 totaling $3.9 billion. Broward and Palm Beach each accounted for approximately $1.5 billion in sales and Miami Dade chipped in $930 million.

• A total of 77% of sale activity was for properties built after 1980. Value-add properties are becoming harder to find.

• Private capital remains active and new private capital continues to enter the market. Five of the 11 of private capital sales were first time buyers in Florida.

• Rental demand is strong. Net absorption of 9,796 units in 2018 outpaced new supply of 6,997 units.

• The homeownership rate decreased from 69.2% to 57.9% from 2005 to 2018.

• Rents are at record levels for the ninth year in a row. For only the third time in 10 years, income levels grew at a higher percentage rate than rental rates.

• Vacancies are near record lows at 4.8%, despite more than 60,000 apartment completions in the last eight years.

•Cap rates are stable. A stabilized 10-year treasury will soften any cap rate fluctuations. Class A: 4.25%-4.75% Class B: 4.75%-5.50% Class C: 5.50%-6.50%

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.