The advent of connected devices and the Internet of Things (IoT)is opening exciting new doors in the insurance industry. The autoliability market has transformed from one in which underwritingrelied on proxy variables such as driving history, demographics andcredit scores to one in which telematics and real-time,personalized driving statistics inform risk assessment.

|As a result, it is estimated that when compared tonon-telematics policies, telematics policies result in 50% fewer claims on average, and that insurerswho employ the innovative technology see improvements in underwriting profits of about 4%. Yet workers'compensation loss trends have not yet benefited from thistechnology.

|According to the National Safety Council (NSA), work-relatedtransportation incidents remained the most common fatal eventcause, totaling 2,083 deaths in 2016.

|Related: Leveraging technology for workplacesafety

|Now, as workers' compensation (re)insurers face increasingregulatory pressures, greater competition, and limited premiumgrowth, they must take the next leap in risk reduction andmitigation by fully adapting lessons learned by auto carriers toleverage telematics, wearables and other IoT technologies toenhance existing safety and wellness programs.

|Workers' compensation carriers have long understood that propersafety training, health incentives, and medical services prevent orreduce claim costs. Reductions in loss frequency and loss ratiossince the early 2010's have been largely attributed by the NationalCouncil on Compensation Insurance (NCCI) to such initiatives.

|For example, 2015 frequency decreased 3% over 2014 according toNCCI, and an August 2011 brief noted carriers with over USD 100million in payroll enjoyed larger frequency declines because they“might be better equipped to implement loss control and safetyprograms.”

|Looking at the data

The latest data from the Bureau of Labor Statistics indicatesthere were 48,500 fewer nonfatal workplace injuries and illnessesamong private employers in 2016 than in 2015. Also, employers withWellness Programs, which “can be valuable for older workers, whotend to have issues with flexibility and co-morbidities” arereportedly experiencing lower workers' compensation losses.

|Now, as workers' compensation carriers look to furtherdifferentiate, the second wave of disruptive innovation isfeaturing telematics, wearables and other IoT devices.

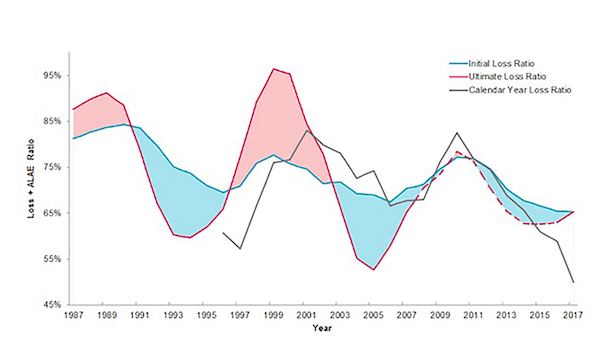

|From 2009 to 2011, workers' compensation carriers experienced abrief spike in loss ratios. In the immediate years following, rateincreases contributed to improvements in accident and calendar yearresults. However, more recently, the sustained success in this linehas been driven by favorable reserve development and reducedseverity trends (see the graph below) driven by safety and wellnessprograms, resulting in improving loss ratios.

|Related: 10 more issues impacting workers' compensation in2018

As of 2017, Guy Carpenter Risk Benchmarks research shows thataccident years 2013 to 2016 saw reserve releases totaling 4.4% ofyear-end 2016 estimated ultimate reserves. And while workers'compensation direct written premium in the U.S. grew only 4%annually from 2013 to 2017, the 2017 national loss ratio is 7points below the average for the same period.

|To continue this positive trend, carriers must now look toharness the technological advances that have spurred application ofwearables, sensors, and drones in the workplace to a greater degreegoing forward. In 2015 the Industrial IoT market was valued at USD113.71 billion; this figure is expected to jump to USD 195.47billion by 2022, representing a compound annual growth rate of 7.89% for the period.

|As of March 2017, 67% of respondents in the industrialmanufacturing sector indicated an ongoing smart factory initiative,and General Electric predicts investment in the space will top$60 trillion in the next 15 years.

|What these numbers mean

These statistics indicate a growing synergy between connecteddevices and loss control improvements and post-claim loss costcontainment and mitigation.

|Workers' compensation insurers stand to benefit from thesetrends more than others, as there is significant indirect lossrelated to the decreased productivity of injured workers. Byemploying wireless sensors, mobile devices, and wearables,employers and insurers can improve business results and employeesatisfaction.

|Traditionally, workers' compensation insurers' risk assessmentwas based on data collected at certain times of the year, such aspolicy renewal. And parts of the data set may rely on qualitativemetrics like standard loss survey questionnaires, which can omitpertinent questions. By using telematics, employers and insurerscan collect real-time data and institute a continuous feedback loopto identify unsafe conditions, immediately warn a worker who may beat risk and monitor and reward those who take correctiveaction.

|This will also generate a much larger and more granular data setfrom which to draw insights to apply to other similar insured riskswho may not be as advanced in their collection of exposureinformation. By leveraging big data and predictive analytics, theycan then develop more accurate premiums for these insureds, refinepolicy coverages and exclusions and recommend prescriptive safetymeasures.

|Carriers can derive additional value by extending telematics todownstream processes like claims handling. For example, the medianamount of time a worker with a lumbar strain misses from work is 10days, while a typical employee with depression with anxiety willmiss work for 26 days. However, when an employee suffers from bothconditions, median return to work duration increases to 153days.

|Biosensors, actuators, and gyroscopes can capture leadindicators of such cognitive conditions, including heart rate,stress level and fatigue, helping insurers triage claims with thepotential to become “jumper” claims that escalate quickly. Suchdevices can also send an alert to notify the wearer if they arepracticing improper posture that could delay recovery.Additionally, telematics can keep the injured employee engaged intheir rehabilitation by alerting them to missed medications orrewarding performance of physical therapy.

|Workplace sensors can also automate and increase the speed ofclaims adjustment by quickly detecting damage or injury, initiatingreserving processes and alerting insurers and safety managers.Real-time data will also improve employers' and insurer's abilityto detect fraud. And by reducing the time and paperworktraditionally associated with claims resolution or litigation,these applications not only reduce the loss component of acarrier's combined ratio, but the expense component as well.

|Looking ahead

At a time when top-line growth is difficult to achieve, carriersmust find ways to differentiate themselves. Implementation ofadvanced smart equipment and a robust wearables program offersinsurers this opportunity. It is perhaps no coincidence that as theprevalence of these devices increase, the gap between the bestperforming workers' compensation insurers and the worst iswidening.

|In 2017 the difference between the initial estimated loss ratioof the 90th percentile carrier and the 10th percentile carrierincreased to 27.2%, up from 26.2% in 2016.

|This brave new world of telematics and connected devices hasalready impacted the auto insurance market in a positive way. Nowit's time for the workers' compensation market to take notice andadvance its investment in this exciting new space.

|Related: Piece by piece: The state of affairs in theconstruction industry

|Emil specializes in Workers Compensation exposure,experience and catastrophe modeling advisory and in the executionof optimal underwriting and (re)insurance applications andsolutions. He can be contacted at [email protected]

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.