For eight consecutive years, Florida has escaped hurricanedamage. As Floridians thank their lucky stars for the eight-yearreprieve, it is important to recognize that the absence of recentcatastrophic windstorms is a lucky break, not a rewrite ofFlorida's hurricane history.

|The Insurance InformationInstitute (I.I.I.) and the Florida Insurance Council (FIC) took alook at historical storms impacting Florida and determined thecosts of history repeating itself.

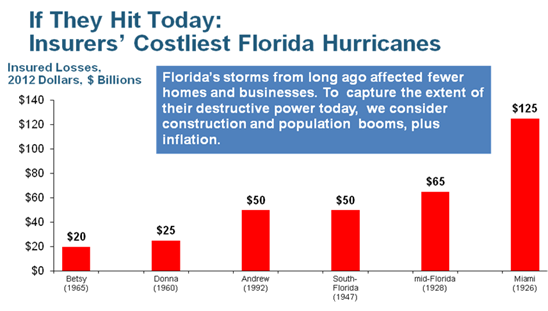

|When Hurricane Andrew hit Homestead, Florida, in 1992, it causedmore than $16 billion in insured losses at that time. If Andrewwere to hit today, estimated losses would be more than three timeshigher: $50 billion.

|“It's not merely inflation that drives up the costs,” said SamMiller, FIC's executive vice president. “Florida has seen continuedpopulation growth in the two decades since Andrew hit, along withincreased construction. There are simply more people and moreproperty at risk,” Miller explained.

|Insurance companies review historical losses to prepare for whatmay lie ahead—they must have the financial resources available inadvance to pay anticipated claims, and past losses dictate theirdecisions. Storm-free years allow insurers to build up thefinancial resources to handle future natural disasters.

|The biggest storm to hit Florida was the Miami Hurricane of1926. It was a Category 4 storm that brought an abrupt end toFlorida's first real estate boom and ushered in an early launch ofthe Great Depression for the region. Few buildings were leftstanding after the storm struck. If a repeat of the 1926 stormoccurred now, insured losses would be in excess of $125billion.

|“The history of Florida hurricanes functions as an early warningsystem and is the biggest factor affecting insurance premiums,”said Lynne McChristian, Florida representative for theI.I.I.

|

Although the last hurricane to hit Florida was Hurricane Wilmain 2005, the state still has a lock on the #1 slot for insurancedollars paid out for claims related to catastrophes. Over a 30-yearperiod, property losses for Florida represent 15.3 percent of allcatastrophe claims paid out in the U.S. Texas is ranked second with10.8 percent, while Louisiana is third with 9.3 percent.

|Another hurricane will come, and it is hard to predict exactlywhere and when it will strike, and how powerful it will be.However, insurers are already taking lessons from history in orderto be financially prepared to pay claims and be able to deal withany future storms.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.