NU Online News Service, Nov. 23, 10:22 a.m.EST

|On the heels of a report from one rating agency showing thatU.S. property and casualty results are down for the first ninemonths of 2011 compared to 2010, another rating agency reports that2011 third quarter net income for its rated companies, at $1.6billion, is also down sharply from the 2010 third quarter, when netincome was $5.4 billion.

|In a Special Comment, Moody’s Investors Service says the drop isdue largely to catastrophe losses, but points out that thecompanies collectively were able to report a net profit.

|Moody’s report comes shortly after a Fitch Ratings report noting that a group of 47 insurers andreinsurers it tracks reported a net profit of $9.7 billion duringthe first nine months of 2011 compared to a net gain of $26.4billion during the same period last year.

|Regarding its report on just third-quarter results, Moody’ssays, “Net income was down nearly 70 percent in [the 2011 thirdquarter] versus [the 2010 third quarter], again reflectingcatastrophe losses as well as small realized capital losses.Investment-market volatility during the quarter led to a downturnin some insurers’ investment performance, particularly stocks asthe S&P 500 declined by 14 percent.”

|Moody’s says the decline in investments reflects the lowinterest-rate environment.

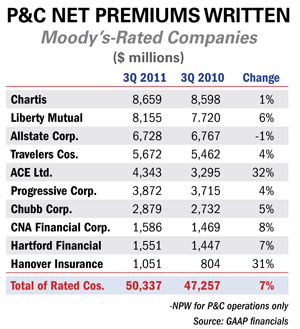

| In a bit of good news for the industry, Moody's saysincreased exposures and stabilizing rates drove a 7 percentincrease in net premiums wrtten for the 2011 third quarter comparedto the 2010 third quarter. "According to pricing surveys andconference calls, pricing continued to stabilize this quarter withmost commercial lines insurers reporting flat or slightly increasedrates, depending on the line of business."

In a bit of good news for the industry, Moody's saysincreased exposures and stabilizing rates drove a 7 percentincrease in net premiums wrtten for the 2011 third quarter comparedto the 2010 third quarter. "According to pricing surveys andconference calls, pricing continued to stabilize this quarter withmost commercial lines insurers reporting flat or slightly increasedrates, depending on the line of business."

Moody's adds that the excess and surplus business appears to bemoving back to the E&S market as well. In October, at theNational Association of Professional Surplus Lines Offices' annualconference, E&S executives said this is a sign they were looking for before buying into the idea that themarket is turning.

|For personal lines, Moody's says rates continue to increase asthey have for the past two years.

|Moody's indicates that it expects modest premium growth tocontinue as companies seek further rate increases.

|As was noted in Fitch’s nine-month report, Moody’s says the 2011third-quarter showed continued reserve releases by P&Cinsurers, but at a lower rate than 2010. “Our preliminary aggregateindustry reserve analysis suggests U.S. reserves remain modestlyredundant across the industry with larger redundancies in personalauto and medical professional liability.”

|Moody’s adds that standard commercial lines remain slightlyredundant, but some line such as workers’ compensation and generalliability have deficiencies in recent accident years.

|Moody’s says that while 2011 will be remembered for significantcatastrophes, it may also be remembered for the industry reachingan inflection point for pricing after multiple years of declines.“The recent stabilization in pricing and relatively benign losscosts should help stem deterioration in future underwritingperformance as the premiums are earned,” Moody’s says. “However,P&C insurers face headwinds from weak underwriting marginsyear-to-date, low investment yields and sluggish economicgrowth.”

|Moody’s believes these challenges should help fuel further priceincreases for P&C insurers.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.