NU Online News Service, Sept. 6, 3:13 p.m.EDT

|Recent catastrophe losses have provided momentum for reinsurancerates to harden, and demand for reinsurance is expected to pick up,leading Moody's Investors Service to revise the sector's outlook to“stable” from “negative.”

|“Following the worst quarter for natural catastrophes since [the2005 third quarter]…not only have significant price increases beenreported for some loss-affected regions/lines, but short-tail,non-loss-affected areas have seen pricing stability,” Moody's says,adding that general consensus after June and July renewals pointsto U.S.-catastrophe price firming of 5 percent to 10 percent.

|Moody's states, “Although future pricing will key off theAtlantic hurricane season, we envisage broadly stable tostrengthening prices at the forthcoming Jan. 1 renewals.”

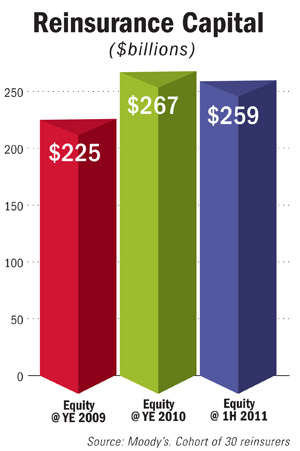

| The cat losses this year have also led to a halt inreinsurers' capital growth that occurred in 2009 and 2010. “Todate, 2011 has witnessed a small reduction in the industry'scapital cushion, driven by heavy cat losses.” Moody's says thiscapital development has “at least moderated somewhat thesupply/demand imbalance” for reinsurance.

The cat losses this year have also led to a halt inreinsurers' capital growth that occurred in 2009 and 2010. “Todate, 2011 has witnessed a small reduction in the industry'scapital cushion, driven by heavy cat losses.” Moody's says thiscapital development has “at least moderated somewhat thesupply/demand imbalance” for reinsurance.

Capacity appears ample for now, Moody's says, but the ratingagency notes capital positions may not be as strong as they appear,and while reinsurance demand is restrained for now, furtherreduction in capacity could change that. “One large hurricane couldtip the balance in favor of demand over supply, as it would almostcertainly lead to reduced equity at year-end 2011, for somecompanies significantly so,” Moody's says.

|Aside from reductions in capital driving up demand, Moody's saysit recently surveyed primary insurers in the U.S. and Europe, andmore are now saying they are uncertain as to whether they plan tobuy more reinsurance protection, as opposed to stating a clear “no”last year. While primary insurers' balance sheets strengthened in2010, allowing them to retain more risk, Moody's says it believesthe primaries have “little flexibility left in further reducingreinsurance usage.”

|Furthermore, Moody's says the increased assessment of U.S. windexposures according to the new Risk Management Solutions (RMS)model, as well as increased capital demands under Europe's SolvencyII regulatory regime, could increase demand for reinsurance in thefuture.

|In general, with respect to demand, Moody's says, “Our mostlikely global macro-economic scenario for 2011-2012 of a sluggishrecovery in the world economy…would at least lead to a moderateuptick in insurance demand.”

|Reinsurers will have to contend with pressure to short-termprofitability. Pricing has been competitive in the recent past,Investment returns remain suppressed because of low yields, andreinsurers have already exceeded their cat budgets for 2011,Moody's says.

|But the rating agency adds that, depending on cat activity forthe rest of the year, it expects reinsurers' underlying loss ratiosto at least stabilize during 2010 as pricing hardens.

|Reinsurers also have to deal with depleting reserve cushions.Moody's says overall redundancies for standard commercial linesstand at around $2.5 billion, with those redundancies concentratedin the 2004 to 2008 accident years. Moody's expects that 2009 and2010 were moderately deficient, and says despite small pricingincreases, 2011 will end up deficient as well.

|“While these potential deficiencies could ultimately drag on thesector's profitability, not all reinsurers are equally exposed,”Moody's says. “In particular, we believe that firms with sizablecasualty businesses will be the most challenged, as these companiesare vulnerable to unexpected shifts in loss-cost trends.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.