The Republican proposal to cap mortgage interest tax deductionsat $500,000 in principal is three times more likely to hurthomeowners in Democratic-leaning counties than in counties wheremore voted for Donald Trump, according to an analysis of data fromATTOM Data Solutions and others.

|Republicans unveiled their tax bill last week. Its call for areduction in the home mortgage interest deduction brought immediatecriticism from home builders and others. The House Ways and Means Committee beginsconsidering amendments this week.

|ATTOM Data Solutions of Los Angeles counted the number ofmortgages exceeding the $500,000 cap in 2,294 of the nation's 3,141counties. ATTOM found 325,286 originations so far this year forthese large mortgages, or 5.4% of the 6.1 million total.

|The political effect is seen by pairing the ATTOM data with acounty-level election dataset of 3,141 counties compiled by TheGuardian, a British newspaper, and townhall.com, a conservativewebsite. The two data sets matched for 2,294 counties, accountingfor 93% of the total presidential vote.

|

In the 424 counties where more votes went to Hillary Clintonthan to Donald Trump, mortgages worth more than $500,000 accountedfor 261,842, or 7.7%, of the total 3.4 million purchase andrefinance mortgages.

|In the remaining 1,870 counties where more votes went to Trump,only 63,444, or 2.4%, of the 2.7 million mortgages were over$500,000.

|A homeowner with a mortgage over $500,000 was twice as likely tolive in a “blue” state than a “red” one. The 23 states with aClinton plurality had 223,024, or 69%, of the nation's largemortgages.

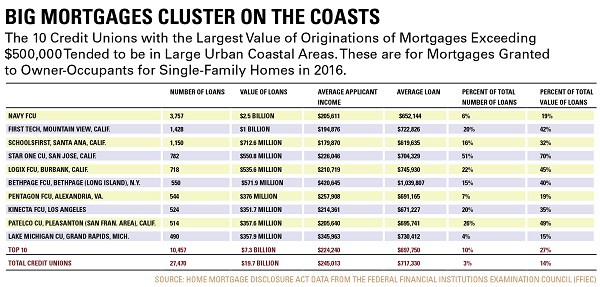

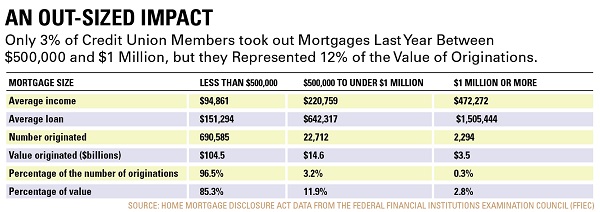

|Credit unions have a slightly lower proportion of big mortgagesnationally. Home Mortgage Disclosure Act (HMDA)origination data for 2016 shows mortgages of more than $500,000accounted for 3.5% of the number of owner-occupant, single-familymortgages, and 14.7% of their value.

|Mortgage interest deductions now stop after the first $1 millionof home loans. Republicans propose lowering the cap to$500,000.

|The proposed tax increase affects only the amount exceedingthe cap. So a homeowner with a $1.3 million mortgage now gets taxdeductions on $1 million of that loan and $300,000 is excluded. Ifchanged, the homeowner would deduct based on $500,000 and $800,000would be excluded.

|Based on last year's credit union originations, the current lawexcludes about $1.2 billion in credit union mortgage value beyondthe $1 million cap.

|With the cap lowered to $500,000, an additional $4.4 billionwould be excluded from deductions for those with loans of $500,000to $1 million.

|The 10 credit unions that granted the largest amount ofmortgages exceeding $500,000 accounted for 37% of the loan valuefor single-family homes to owner-occupants last year, according toHMDA data.

|

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.