If credit unions can't beat the fintechs, why not join ’em?

|That's what nine credit unions in New York, Florida and Alabamaare doing in a six-month pilot project with LEVERAGE, thefor-profit subsidiary of the League of Southeastern Credit Unions, and Linqto, a SiliconValley company that specializes in software for fintechapplications.

|The short-term goal of the pilot project is for credit unions towork with fintech developers to determine what specific apps aremost likely to appeal to existing and prospective millennialmembers.

|The long-term goal of the project is to help fintech companiesmonetize their apps and enable credit unions to use popularunbundled, or single-function, apps – an emerging trend among youngconsumers, who find these apps more convenient and easier touse.

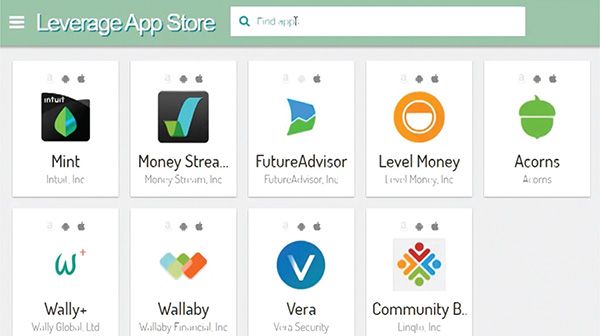

|The centerpiece of the pilot project, launched in April, is theLEVERAGE app store, which features white-label fintech apps such asMint, Money Stream, FutureAdvisor, Level Money, Acorns, Wallaby,Wally+ and Vera.

|But unlike the Apple, Android and Amazon app stores, theLEVERAGE app store is exclusively powered by Linqto'spatent-pending software platform, Otter.

|According to Linqto, it has developed a first-of-its-kindplatform that enables credit unions to select popular fintech appsand upload their customized brands within those apps to market totheir members and prospective members.

|Developing, testing and implementing an app - something thatused to take a financial institution six months - can now take sixminutes, according to Linqto.

|The Otter platform enables both fintech companies and creditunions to achieve two important goals, Linqto said.

|“Fintech apps are having a problem in monetizing [their apps],”Linqto CEO Bill Sarris said. “They may have been successful inattracting the millennial market, but their apps had to be free inthe Apple store. Developers have realized they can't charge fortheir apps. It's the kiss of death. In our system, credit unionspay for the branding and usage rights of an individual app. Thenthe developer keeps 70% and the app store keeps 30%, but theconsumer doesn't pay anything for the app.”

|| Sarris previously workedas a senior technology engineer and consultant for Mint,QuickBooks, QuickBooks Online, Intuit Paper Trail, Intuit PartnerPlatform and Intuit websites. His development experience includedweb, iOS, Android and desktop versions of Intuit products.

Sarris previously workedas a senior technology engineer and consultant for Mint,QuickBooks, QuickBooks Online, Intuit Paper Trail, Intuit PartnerPlatform and Intuit websites. His development experience includedweb, iOS, Android and desktop versions of Intuit products.

Patrick LaPine, president/CEO of the Southeastern league andLEVERAGE, said Linqto is contributing millions of dollars tosupport the pilot project. About half of that amount will becommitted to helping credit unions market and promote the apps tomembers and millennials. LEVERAGE has also earmarked resources tosupport the pilot project.

|Linqto selected the Southeastern league because of its diversedemographics in Alabama, Florida and New York. Last year, theSoutheastern league forged a collaborative partnership with the NewYork Credit Union Association and invited cooperatives from theEmpire State to participate in the pilot project.

|The New York credit unions involved in the pilot are the $6.6billion Bethpage Federal Credit Union in Long Island, the $979million CFCU Community Federal Credit Union in Ithaca and the $78million Inner Lakes Federal Credit Union in Westfield. The Floridacooperatives are the $724 million First Florida Credit Union inJacksonville, the $176 million Members First Credit Union ofFlorida in Pensacola, the $79 million Buckeye Community FederalCredit Union in Perry and the $75 million Sun Credit Union inHollywood. The Alabama credit unions are the $705 million AlabamaCredit Union in Tuscaloosa and the $573 million Family SecurityCredit Union in Decatur.

|“I think this is a great opportunity for us to learn from afintech company, to learn about their processes, how they go aboutproduct development and how they conduct pilot programs,” LaPinesaid. “It's like going to fintech school for six months.”

|Every Thursday morning, Linqto executives, fintech developersand credit union executives hold a phone conference to discussmobile apps and exchange ideas about how they can be used in themarketplace.

|“What is wonderful about it is how both sides are willing tocooperate,” Sarris said. “They really want this to happen. So manygreat ideas come up from both sides about how developers canslightly modify their apps so they could be more advantageous tocredit union members.”

|For example, one recent phone conference focused on the Wallabyapp, which tells consumers as they shop which credit card can offerthe most rewards, the best interest rate and the lowest fees, andoffers other financial data.

|“Part of the discussion we had recently was how can an app bemodified in a credit union's market when millennials download theBethpage-branded Wallaby app, for example,” he explained. “If theyaren't a member of Bethpage, the credit union's Visa card wouldcome up and show them that if they would use the credit union'scard, they would get more rewards or a better interest rate thanother cards.”

|| An “applynow” button in the app would show the benefits of the card in realtime and invite young consumers to become members of the creditunion to reap more benefits.

An “applynow” button in the app would show the benefits of the card in realtime and invite young consumers to become members of the creditunion to reap more benefits.

“These are some of the general conversations that are going onthat are focused on how you use new fintech apps to attract newmembers and not just provide additional services,” Sarris said.

|Throughout the pilot project, the credit unions will test theapps and determine which ones appeal to members and prospectivemembers.

|“When you get to the end of this, there is no one credit unionthat is going to have 200 apps – one credit union might have two,three or four,” he said. “The pilot program is very hands-on tomake sure this happens successfully by the time we get to thegeneral launch of the LEVERAGE app store.”

|Credit unions participating in the pilot project have alsoinquired about fitness, lifestyle and gaming apps as another way toattract young members.

|“There are all different kinds of apps that can come into playbecause when you think of the phone screen, it's become like thenew marketplace or the new billboard,” he said. “If you have onemonolithic banking app like most banks and credit unions have, youprobably have 12 to 15 different features in it and you have to gothrough 14 different screens in the app to get to what you want.But that isn't how mobile apps work, and it's why traditionalbanking has lost the millennial marketplace.”

|As a result, more companies are unbundling their multifunctionalapps and creating single-function apps.

|For example, American Express features several single-functionapps that help their customers manage business receipts, collectreward points from other retailers they shop at, and experience acinematic, interactive Taylor Swift music experience.

|The new unbundled app trend stems from the fact that it is mucheasier and less time consuming for consumers to click on onesingle-function app to get their tasks done, Sarris noted.

|He said one credit union came up with the idea of branding apopular gaming app and using it to start a consumer competition forthree months. Whoever scored the highest number of points wouldreceive a $1,000 prize from the credit union.

|“I think we are getting great ideas, simply marketing ideas thathave nothing to do with fintech, but it's all about attracting themillennial market and bringing them into the credit unionmembership,” he said.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.