What doNew York City yellow taxicabs drivers, Evangelical Christians andeastern European immigrants have in common? They all depend oncredit unions to own a business, worship at their church and own ahome.

What doNew York City yellow taxicabs drivers, Evangelical Christians andeastern European immigrants have in common? They all depend oncredit unions to own a business, worship at their church and own ahome.

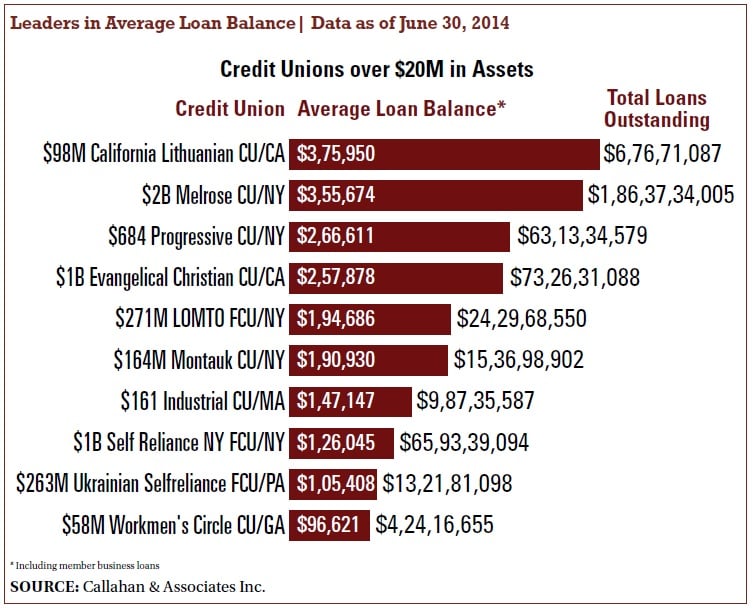

According to data analyzed by Callahan & Associates forCU Times, four of the top 20 credit unions with thehighest average loan balances cater to the Big Apple's $5 billiontaxicab medallion lending industry. Taxi medallions are licenses that allow for the ownership andoperation of a taxi. The average cost of a medallion is $967,000,according to the New York City Taxi and Limousine Commission. Theaverage cost for a medallion of a taxicab that is operated by afleet company is $1.1 million.

|The $274 million LOMTO Credit Union in Woodside, N.Y., finances medallions forindividual drivers while the $2 billion Melrose Credit Union inBriarwood, N.Y., and the $668 million Progressive Credit Union inNew York, provides loans to taxicab fleet owners.

|The $167 million Montauk Credit Union, also based in New York,serves the individual and fleet owner markets, according to RichardKay, president of the Taxicab Service Association.

|Kay also is the president/CEO of LOMTO, which carries the fifthhighest average loan balance per member of $194,686 as of June 2014on the CU Times Top 20 list of the leaders in average loanbalance.

|“Our members here are not really wealthy people for the mostpart. They are cab drivers,” Kay said. “These members arehardworking blue-collar guys that elevated themselves in the taxiindustry to own a medallion instead of driving for somebody else,which is why they have these large loan balances.”

|Melrose Credit Union managed the second highest average loanbalance at $355,674 as of June, according to the CU Timeslist. Progressive ranked third with an average loan balance of$266,611 and Montauk ranked sixth with an average loan balance of$190,930.

|Read more: Churches aren't cheap …

||The Institute for the Study of American Evangelicals in Wheaton,Ill., estimated 100 million Americans are evangelicals who worshipand socialize at thousands of churches across the nation. Some ofthese worship centers in 30 states are financed by the $1 billionEvangelical Christian Credit Union in Brea, Calif.

|“We look a lot like a commercial bank from our customer base,”Mike Boblit, vice president for Evangelical Christian, explained.“The majority of our members are not exclusively churches, but themajority of them are churches and the majority of our loans arereal estate- secured loans that are secured by churchfacilities.”

|That may also explain why Evangelical Christian has the fourthhighest average loan balance of $257,878 on the Top 20 list.

|“We really began in earnest [to lend to churches] 20 years ago,”Boblit said. “There was a real recognition that many churchesdidn't have a lot of options for borrowing money because commercialbanks didn't really understand their source of income and theirexpenses. When we started church loans, it was primarily related toour ability to understand income sources, understand how churchesspent money and how to assess whether the church would repay theloan.”

|Like the housing market, churches were not immune to the impactof the Great Recession. From 2009 to 2011, Evangelical Christianposted a total net income loss of more than $39 million, accordingto NCUA financial performance reports. The California cooperativewas also embroiled in foreclosure cases that drew national mediaattention about church bankruptcies.

|Though Evangelical Christian's total loans and loan incomecontinued to decline slightly in 2012 and 2013, the credit unionmanaged to turn a total net gain of $7.4 million in those yearsaccording to NCUA financial performance reports.

|While the credit union posted a net income gain of $2.3 millionat the end of the first quarter this year and only a small netincome loss of $657,389 at the end of June 2014, it recorded a netincome loss of $14.7 million by third quarter's end, according toNCUA financial performance reports.

|To diversify its portfolio, Evangelical Christian plans toexpand its retail consumer products and services through web andmobile banking, according to Boblit. Earlier this year, the creditunion hired Robert McDougall, a former executive with JP MorganChase Bank, to oversee this new initiative.

|Read more: MBLs to immigrants build balances…

||The $260 million Ukrainian Self-Reliance Federal Credit Unionwas established in the early 1950s to serve Ukrainian WWII immigrants.

|“When they immigrated to this country, the first thing theywanted was a home, a permanent place to be part of the community,”Mary Kolodij, president/CEO of the Philadelphia-based cooperativeand a first generation American of Ukrainian immigrant parents,said. “But they could not get loans not because they were notcreditworthy or that they weren't smart enough, it was just alanguage difficulty.”

|Because many of Ukrainian Self-Reliance's employees can fluentlyspeak Ukrainian and Russian, the cooperative has built a loyalmembership base, according to Kolodij. The majority of them use thecredit union as their primary financial institution, she added.Ukrainian Self-Reliance also has recently moved into the memberbusiness loan arena for those who are investing in rentalproperties.

|Of its 1,290 retail loans, more than 960 are first mortgageloans worth $129 million, according to Ukrainian Self-Reliance'sNCUA 5300 report. What's more, those loyal members have helped thecredit union achieve a No. 9 ranking on the CU Times Top20 list with an average loan balance of $105,408.

|Other credit unions that primarily serve eastern Europeanimmigrants made the Top 20 list as well. The $98 million CaliforniaLithuanian Credit Union in in Santa Monica, Calif., was No. 1 withan average loan balance of $375,950, and the $1 billion Self Reliance New York, which serves Ukrainian immigrants, wasranked eighth with an average loan balance of $126,045.

|Self-Reliance manages a first mortgage loan portfolio of $647million and California Lithuanian holds a first mortgage portfolioof $67 million, according to their respective 5300 reports.

|Throughout the 1990s, a new generation of eastern Europeanimmigrants flowed into the U.S. after the fall of the Berlin Wallin 1980, Kolodij said.

|“As these immigrants have assimilated into their communities andhave become more financially sophisticated, we are increasing ourtypes of products and services so that they will continue to use usas their primary financial institution,” she said. “In about amonth, we will be introducing mobile banking with remote captureand new Visa cards with rewards programs.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.