(Photo:Rido/Shutterstock.com)

(Photo:Rido/Shutterstock.com)

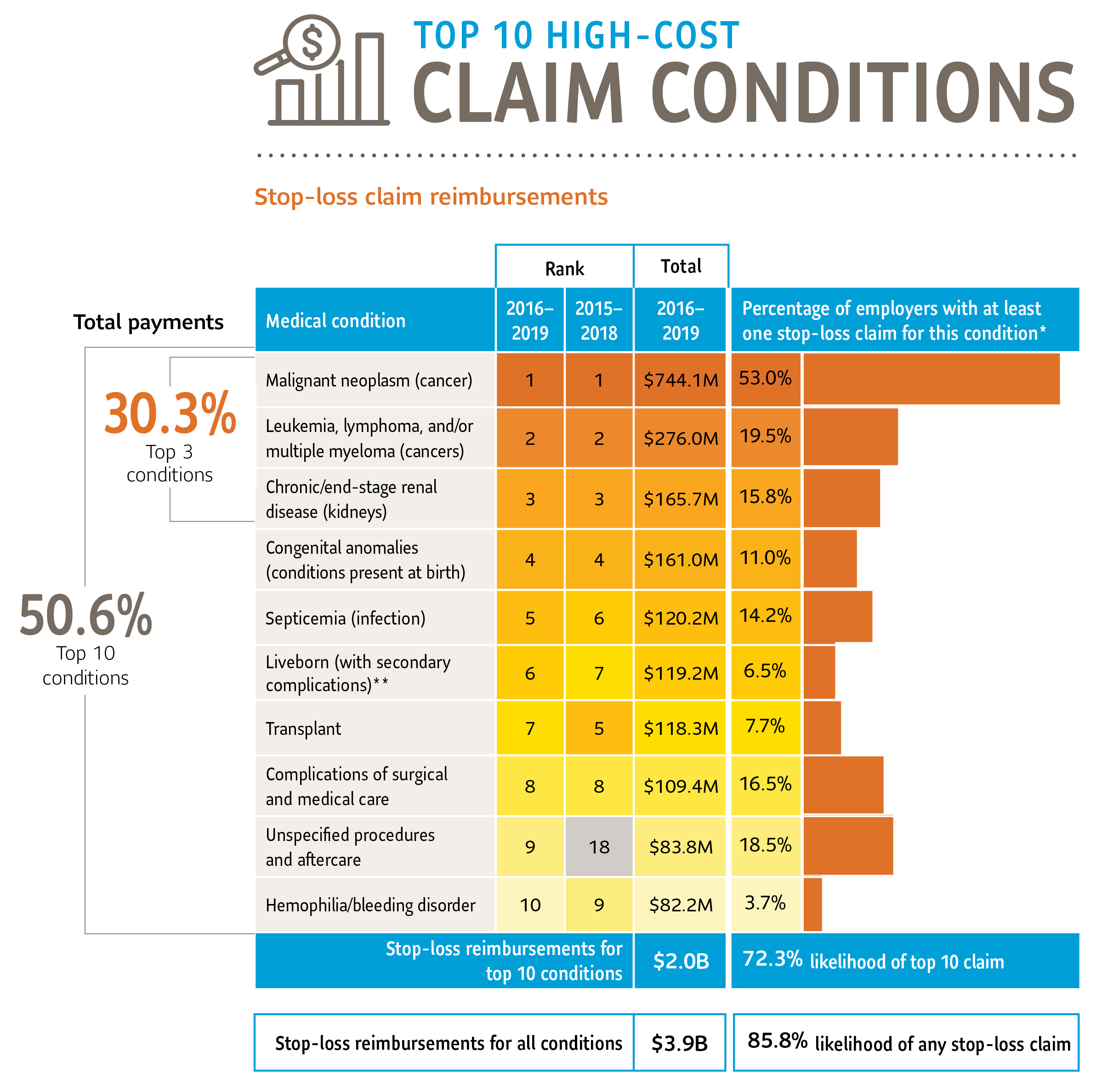

Since 2010, cancer has consistently topped Sun Life's annuallist of high-cost claim conditions. With the American CancerSociety having predicted 1.7 million new diagnoses last year, it shouldbe unsurprising (if no less sobering) that 2019 was noexception.

|The latest stop-loss report from the financial servicescompany shows cancer in the top two spots, making up 26% ofstop-loss reimbursements. Chronic/end-stage renal disease roundsout the top three conditions. Diabetes was the second costliestcondition associated with chronic/end-stage renaldisease. Transplants and congenital anomalies (conditionspresent at birth) also ranked high on the list.

| Source: Sun Life

Source: Sun Life

Cancer also holds the top six positions on the list of 20high-cost injectable drugs, with another cancer treatment (Yervoy)coming in at number nine. According to the report, $306.2 millionwas spent on injectable medications in 2019, with $185.6 million(61%) attributed to the top 20 on the list. Five cancerdrugs—Herceptin, Opdivo, Neulasta, Keytruda, and Avastin—made up27% of the total injectable drug cost overall.

|Zolgensma, a gene therapy approved last year for the treatmentof spinal muscular atrophy, had the highest average cost at$2.2 million per member.

|From 2016 to 2019, the report states, 24% of employers had atleast one member with over $1 million in claims. Claims between $2million and $3 million rose 44% and those totaling $3 million ormore doubled. Of the 14 members in the $3 million or more category,most of the main contributing conditions were congenital anomalies,cancer conditions, and genetic disorders. Most of the patients inthis category had a combination of complicated procedures, advancedlife-sustaining treatments or other complications requiringextended in-patient stays. For four of those members, high-costdrugs played a crucial role in the final tally.

|The report also notes that 46% of million-dollar claimswere for patients under the age of 20, with 71% of the $3million+ claims for patients under 12. The leading high-cost claimwas congenital anomalies for those under age two. Cancer was themost common claim category for ages 2-19, and hemophilia was theleading condition for ages 20-39.

|The report took COVID-19 into account as well, noting that whilemany coronavirus claims did not breach the stop-loss deductiblelevel, stop-loss claims seen to date had hospitalization staysbetween 3 and 35 days. The highest hospitalization cost for onepatient, according to the report, exceeded $190,000.

|"We fully support the expansion of life-saving drug treatmentoptions that are becoming available to patients with cancer andother serious medical conditions. It's also important tonote that this trend of increasing costs will continue, and thetrillions of dollars spent on healthcare are the responsibility ofemployees, their families and the businesses where they work," saidJen Collier, R.N., senior vice president, Stop-Loss & Health atSun Life U.S.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.