The patient sat on the examining table and listened to thedoctor. The emergency was past, the patient was back into all dailyactivities and routines, the numbers looked good, the testsindicated normalcy. "You can go off the blood thinner oryou can stay on it," the doctor said. "If you go off, you riskanother blood clot and death. If you stay on, you risk a brainbleed and death." "I don't know. What should I do?" the patientasked. "It's up to you," the doctor said. The patient stared at thedoctor. Weren't doctors doctors because they could advise you as tothe best course of action? Surely this wasn't how it was supposedto go, being given a choice without any indication of what actionwas better?

|Related: Your plan participants are listening: 4ways to help them

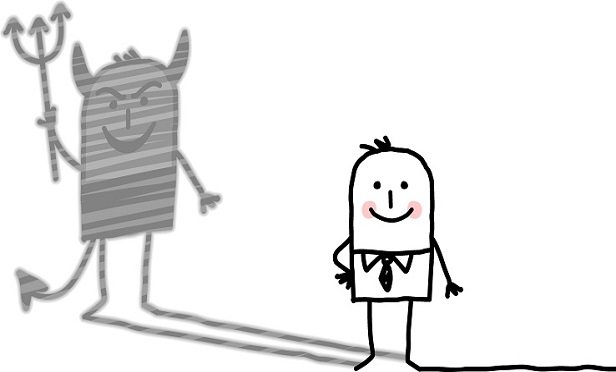

|What has happened with the loan provision in the CARES Act is the financial equivalent of thesituation above. Retirement savers with defined contributionplans are being abandoned on the examining table, left alone tomake important financial decisions that could make or break thequality of their future, yet they aren't given the training andknowledge to help them make those decisions.

|It's not a new situation, unfortunately. Plan participants havehad to make decisions on their own as to what investment options topick and how much to contribute. Plan sponsors have to give themoptions, enough but not too much, so that participants can"choose."

|Yes, "choose." Research shows most plan participants pick thefirst investment option given on the list, no matter what it is.This is exacerbated now thanks to the CARES Act — whereparticipants are given the choice as to whether to take alarger-than-previously-allowed loan from their 401(k).

|How many articles have you seen lately about how people shouldthink carefully before taking out a 401(k) loan? That's arhetorical question — the answer is "quite a few," both in thetrade publications as well as consumer publications.

|Will that stop people from taking out loans that they shouldn't?No. They hear that the CARES Act increases the amount of money theycan borrow from their 401(k) and suddenly, even if they hadn'tthought about it before, borrowing from their retirement plan seemslike a good solution to their coronavirus-caused financialproblems.

|But two, three, four years (or more) down the road, when theyeither cannot pay back the loan or they manage to pay it but loseout on the greater nest egg they could have accumulated had theynot taken a loan, they will have only themselves to blame. Not thepoliticians who gave them the option to borrow a large amount, northe sponsors acting in good faith and offering it as apossibility.

|Given the oft-quoted lack of financial literacy and acumen ofthe average American, there have to be many participants who don'trealize that just because an option is offered, doesn't mean itshould be taken. They're not stupid, they're just English majors.(Just kidding, fellow English majors.) But manyadults – even those who graduated from collegeand might think they have some kind of"extra" knowledge aboutfinance – have had little to noeducation around financialdecision-making, loans, interest rates, or investing.

|A little paternalism maybe wouldn't have hurt, in the case of401(k) loans. (And granted, many plan sponsors andadvisors are concerned about this issue.) Butit's easier and less controversial for lawmakers to appearbenevolent and let people decide to do something that might beharmful to their future. It lets them off the hook: "Hey, you madethe decision, not us."

|A strange kind of shaming, giving people an option withouthelping them see its ramifications, then telling them later theywere wrong to take it. That's about as rational and kind asexperts, politicians, and media telling Americans, a large numberof whom live paycheck to paycheck, to have six months' worth ofsalary saved, to contribute 15% to their retirement plan, to payoff their credit cards at the end of every month, and to have anemergency fund: "Hey, we told you you should do this, but youdidn't, so now look at the mess you're in."

|The patient ended up choosing to go off the blood thinner,reasoning that they knew what it felt like to have a blood clot,but they didn't know what it felt like to have a brain bleed —thus, they could take immediate action if any symptoms of a bloodclot appeared, whereas they might not know to take action ifsymptoms of a brain bleed occurred.

|That was one way to come to a decision. They could also haveconsidered cost of medication or some other reason.

|Still, it might have helped to have a little more inputfrom the expert in that situation before the decision was made. Inthe same way, plan participants might be helped to have a littlemore input before they make their decisions. Of course, thesedecisions aren't life threatening in regards to 401(k)s. But theycould be life-changing, for better or for worse.

|READ MORE:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In