Creative employee perks distract us from serious problems in theworkplace—namely, the retirement crisis. (Image:Shutterstock)

Creative employee perks distract us from serious problems in theworkplace—namely, the retirement crisis. (Image:Shutterstock)

Every day I see another article detailing the latest workplaceperk. These range from the lavish (like an in-house barista orfree concierge services) to the unconventional(pet-friendly workspaces are one thing, but fur-ternity leave?) to the obvious (when didwork-life balance or natural light become a “perk” for aprofessional established in their career?).

|Extras like these can make employees' lives a little easier andhelp create a positive work environment. But it's important to notlose sight of what they really are: workplace extras. An employeerecreation room with a ping-pong table and a masseuse on Fridays dolittle to secure your employees' financial and emotional well-being.

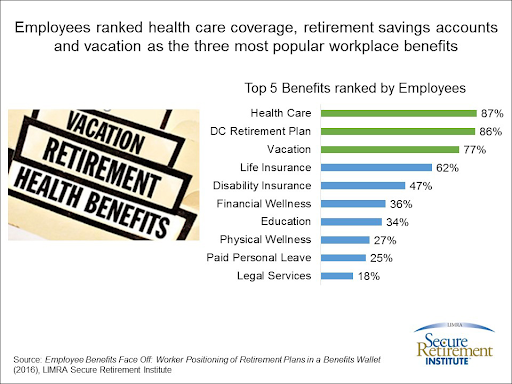

|Unlike perks, benefits go beyond the category of“nice-to-have-but-could-do-without” and include those materialthings, like health care, pensions, and 401(k)s thatmeasurably improve employees' lives. It is not just that realbenefits are highly correlated with employee satisfaction,it is that the revelry over the creation of creative employee perksdistracts us from serious problems in the workplace—namely, theretirement crisis.

|Getting back to real employer responsibilities

What needs to change if we are to avoid the potentialrepercussions of an entire generation of unprepared retirees?

|The first thing that needs to happen is for employers torecognize they have a key responsibility to help alleviate thecrisis.

|In the last two decades, businesses have offloaded more and moreof the responsibility and work surrounding retirement planning ontotheir employees. A 2016 report from Bipartisan Policy Center foundthat just over one third of private-sector employees do not haveaccess to workplace retirement savings plans. Moreover, workerstoday that do have retirement plans are less likely to have definedbenefits plans than they were just 20 years ago, leaving most ofthem with defined contribution plans, primarily 401k's. Between1998 and 2016, the number of Fortune 500 companies offering definedbenefits decreased by around two thirds.

|

In short, Americans are being forced to manage and set asidemoney on their own for retirement, and often without any sort ofmatching program from their employers. And it should come as nosurprise to anyone acquainted with the relevant psychologicalliterature, that putting retirement planning in the hands ofindividual employees is leading to suboptimal results. Humans arenotoriously bad at long-term planning. Toparaphrase Jerry Seinfeld, “retirement is future guy's problem;today guy just wants to have a good time and isn't worrying aboutproblems 20, 30, or 40 years down the road.”

|Public policy has acknowledged this truth of human nature,though it has yet to fix the underlying problem. As Roger W.Ferguson Jr., former vice chairman of the Federal Reserve, points out, the Pension Protection Act of 2006introduced the “automatic revolution,” which allowed employers toautomatically enroll employees in definedcontribution plans. Nevertheless, the median savings in a 401(k) account is stillnowhere near the $1 million, or more amount that Americans need toretire today, hovering at around $76,000 in 2015.

|Employers have a moral responsibility—not to mention incentivesof their own—to help ensure employees can live out their retirementyears in comfort and dignity. That responsibility extends toprotecting workers from themselves. This experiment in divertingthe responsibility of retirement planning to employees has clearlyfailed. No one is saying we should go back to a pension system foreveryone—pensions, after all, have their own risks—but definedbenefit plans had the virtues of being fixed and transparent.Employers should strive to create a system as effective as theseonce were.

|Let's talk about retirement

There are entire schools of management science dedicated totrying to figure out what makes organizational cultures tick, and for goodreason. The qualities of a workplace culture help determine howengaged, satisfied and productive employees will be. But culturecan be put to other purposes, too. Business leaders talk about“fostering a culture of cybersecurity” or a “customer-focusedculture.” The basic idea behind these recommendations is thatcarefully choosing the values a company makes central to itsidentity and then enacting them from the top-down can helporganizations achieve whatever its goals may be.

|Just like we talk about building cultures around cybersecurityawareness and going above and beyond for the customer, companiesthat are serious about their employees' well-being should makeretirement planning—and financial literacy in general—a core workplacevalue. What does that look like? It could mean including retirementand financial planning education in new-hire training, andfollowing that up with quarterly financial education newslettersand seminars. It could mean hiring retirement advisors to meetone-on-one with employees on a regular basis. This all starts withencouraging employees to talk to with one another about theirretirement plans and personal finance habits.

|Back it up with tangible action

Workplace culture initiatives are effective only when theyreflect the decisions of company leadership. For instance, youcannot build a culture around work-life balance if there is ashortage of employees causing everyone to have more on their platesthan can fit into a 40-hour work-week. Similarly, you cannotestablish a culture of responsible financial planning if you do notprovide any kind of retirement savings program. Culture followsfrom values and action, and trying to influence it without takingany concrete steps comes off as hollow and phony.

|Of course, many companies that do have retirement savingsprograms still have a problem with their employees inadequatelysaving. How do you get a retirement-aware culture off the ground inthis scenario? Something as simple as a gamified approach, in whichemployees set goals for financial savings and are held accountableby their peers, can be the spark for a major shift in companyculture.

|From creative perks to creative benefits

Creative perks can be fun, but they do little to improveemployees' financial or personal well-being. Benefits are whatattract employees and secure their short-term and long-term health.Make meaningful investments in this area and maximize their impactthrough strategic design of company culture and you will make realdifferences in employees' lives—building loyalty and increasingengagement in the process.

| India Suter is thedirector of business development for AssetStrategy Consultants, Hunt Valley, Maryland. Working directlywith benefits managers, plan sponsors and HR executives, Indianotes that success begins with being a good communicator and abetter listener.

India Suter is thedirector of business development for AssetStrategy Consultants, Hunt Valley, Maryland. Working directlywith benefits managers, plan sponsors and HR executives, Indianotes that success begins with being a good communicator and abetter listener.

Read more:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.