Today, over 60 percent of allemployers in the U.S. self-insure their employee medical benefits.And the self-insurance rate is poised to grow even more. This maycome as a surprise to those used to the days, not long ago, whenthe majority of employers purchased a fully insured product from aninsurance company, a Blue Cross Blue Shield organization, or aHealth Maintenance Organization (HMO).

Today, over 60 percent of allemployers in the U.S. self-insure their employee medical benefits.And the self-insurance rate is poised to grow even more. This maycome as a surprise to those used to the days, not long ago, whenthe majority of employers purchased a fully insured product from aninsurance company, a Blue Cross Blue Shield organization, or aHealth Maintenance Organization (HMO).

A growing market

Health plans and providers increasingly view self-funding as aviable market opportunity. Many health providers that initiallychose to self-fund their own benefit plan, for example, now desireto introduce a self-funded product in their market. It makes goodbusiness sense. Self-funding offers an opportunity to drive morepatients to provider-owned facilities and capitalize on synergieswith employer clients and distribution partners.

|With the increased popularity of self-funding, many health planshave become active in the employer stop loss (ESL) business – and many more areseeking to enter. ESL insurance allows employers to self-fund whileprotecting against catastrophic or unpredictable losses, as theinsurer provides coverage for losses that exceed defined limits.Exposure from specialty drugs and continued growth in $1 million+claims are among the high-cost growth drivers for ESLinsurance.

|Many regionally based health carriers and several largenationally recognized group life and disability carriers haveentered or are looking to enter the ESL market. Since the passageof the Affordable Care Act (ACA) in 2010, the growth in the ESLmarket has accelerated from a compound annual growth rate (CAGR) of7 percent from 2006-2011 to a 12% CAGR from 2011-2015, with annualESL premiums now totaling $17 billion. At this point, there is noindication that legislation to replace/repeal the ACA will have asignificant impact on this sustained growth.

|The opportunity is clear. The challenge: how to gain access tothe ESL market and build business once there.

|What brokers are seeing

In May 2018, RGA conducted a survey of brokers about the ESLmarket, the participants, and the opportunity. The resultsreaffirmed the need for solutions to facilitate health plans'entrance into and success within the ESL space.

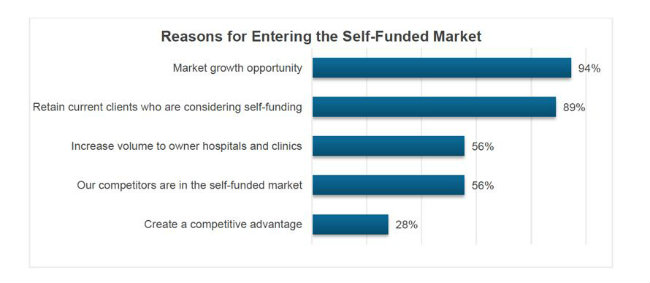

|The top two reasons for health plans entering the self-fundedmarket, as cited by brokers, point to a recognition of thesignificant opportunity presented by this market from both new andexisting customers:

|

So how do you capitalize on this opportunity? We also askedbrokers, who observed their clients' experiences, what theyconsidered the top three factors for success in the self-fundedmarket. Competitive ESL rates topped the list, cited by 85 percentof respondents. The strength of the regional network came next,followed closely by competitive administrative services only (ASO)arrangements and network access fees. Other factors indicated bybrokers, outside of our list of choices, included strong brokerrelationships and competitive broker commissions.

|Interestingly, while competitive ESL rates ranks number one as acritical factor for success, this is not considered the top marketchallenge. That spot belongs to sales training, which was listed asa top-three market challenge by 70 percent of respondents. Havingan understanding of the self-funded market may be even moreimportant, as 50% of respondents ranked it highest. Potential saleschannel conflict and uncertainty as to whether it would be best tobuild, buy or outsource required capabilities were other possiblemarket challenges raised by participants.

|Given these challenges, does outsourcing offer a path to marketentry? In line with a concern about competitive rates and fees,brokers feel that their clients are most likely to outsource thepricing function, policy forms and rate filings, and case levelunderwriting. Sales training was also cited by 50% of respondentsas something that health plans are likely to seek from a thirdparty – likely reflective of the previously indicated marketchallenges of acquiring both sales training and a goodunderstanding of self-funding.

|The market has spoken: the era of self-funding is here. Whilehealth plans and others seek strategies to enter into or advancewithin the ESL space, those industry players developing solutionsto facilitate this process will position themselves for significantgrowth.

||

David Sipprell is Senior Vice President, Managed Care Stop LossTurnkey, at RGA.

|Eva Goldstein is Assistant Vice President, StrategicPartnerships, at RGA.

|Leigh Allen is Director, Global Surveys and DistributionResearch, at RGA.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.