Suppose you're an employer whopays your workers $13 an hour. Under the Stop BEZOS Act, you, theemployer, would be charged $5 an hour per employee in tax. Howwould you respond to this new tax? (Photo: Getty)

Suppose you're an employer whopays your workers $13 an hour. Under the Stop BEZOS Act, you, theemployer, would be charged $5 an hour per employee in tax. Howwould you respond to this new tax? (Photo: Getty)

U.S. Senator Bernie Sanders, a leader of the democraticsocialist movement, is introducing a bill designed to forcecompanies to pay their workers higher wages. The bill is being touted as anattack on Amazon.com Inc. — its name is the Stop Bad Employers byZeroing Out Subsidies Act, which spells out “Stop BEZOS.” Thatwould be Amazon chief Jeff Bezos, the richest person in the world,whose company just passed $1 trillion in market capitalization.Sanders' bill, which would apply to companies with 500 or moreemployees, would levy a tax equal to 100 percent of certaingovernment benefits (food stamps, housingvouchers, school lunches and Medicaid) received by any workers whoearn less than $15 an hour.

|Related: Amazon employees at or near top of food stamp listsin at least five states

|To many on the left, Amazon has become a symbol of Americaninequality, with its owners reaping unprecedented fortunes whileits workers often are eligible for means-tested government benefitslike food stamps. The median annual compensation of an Amazonworker in the U.S. is $34,123 — above the U.S. median personalincome, which stood at a little more than $31,000 in 2016. Andsince personal income also counts government benefits, the typicalAmazon worker is actually probably doing even better relative tothe median. So Amazon is not actually too terrible on this score.But entry-level wages of $13 an hour and poor working conditionsare not a good look for a company whose warehouse jobs areincreasingly regarded as the future of work, and whose search for alocation for its second headquarters has local governmentsscrambling obsequiously to please the online retail giant.

|Sanders is capitalizing on those bad optics to make an exampleout of Bezos and Amazon, and to draw attention to the problem ofcompanies relying on the government to pay their workers' bills.But his plan seems to be much more about grandstanding and pointingfingers than about actual solutions to help vulnerable Americanworkers. If it actually became law, the Stop BEZOS Act would almostcertainly hurt the working poor. Its goals could be achieved muchmore simply and effectively by a combination of a higher minimumwage and an increased earned income tax credit.

|Suppose you're an employer who pays your workers $13 an hour.The workers also get government benefits that average out to $5 anhour. Under the Stop BEZOS Act, you, the employer, would be charged$5 an hour per employee in tax. How would you respond to this newtax?

|One thing you could do is to raise your workers' wages to $15 anhour, in order to no longer be subject to the tax. That's obviouslythe outcome Sanders would like to achieve. But there are otherthings you can do as well. You could fire workers who use lots ofgovernment benefits — for example, single moms with dependentchildren — and replace them with teenagers, middle-classpart-timers or other workers who won't require you to pay theSanders tax.

|That would hurt vulnerable American workers — the people whoneed the money the most would be the most likely to be added to theunemployment rolls. It would also make poor Americans unwilling toclaim food stamps, Medicaid and other government benefits in thefirst place, out of fear that they might lose their jobs. Sandersand his allies would obviously try to counter this outcome withvigorous anti-discrimination lawsuits. In practice, this isn't aworkable solution; workers tend to win only a very small percent ofsuch lawsuits.

|As an employer, a second thing you could do to reduce your taxburden would be to cut wages. Suppose you cut wages for someworkers from $13 to $8, but — because food stamps, Medicaid, andother benefits don't rise 1-for-1 as income falls — they only use$6 in benefits after their wages go down. Now your total bill forthose workers is $14 an hour ($8 in wages plus $6 in Sanders tax).That's even lower than you'd pay if you raised wages to $15. And ofcourse the workers themselves see big drops in their disposableincome.

|Either one of these responses would be undesirable — firingworkers who use lots of benefits, or cutting wages in order to gamethe system. In contrast, the best possible scenario — companiesraise all workers' wages to at least $15 — would be no differentfrom a $15 minimum wage, which Sanders has already introduced as aseparate bill. In other words, the Stop BEZOS Act would either beredundant (if the higher minimum wage were adopted) or be terriblefor the welfare of the working poor.

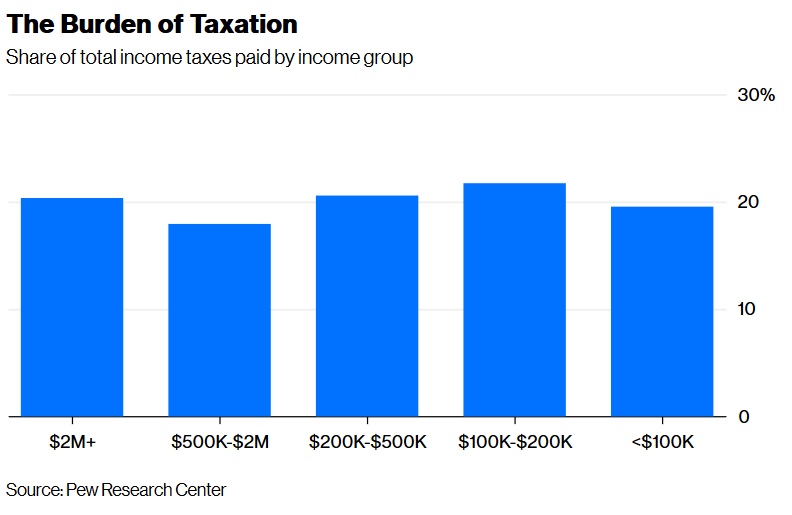

|That suggests that Sanders and his allies either haven't thoughtthrough the economics of their bill, or — more likely — don'treally care. It seems like more of a marketing stunt — an attemptto erode the social status of big businesses and their rich owners,by accusing them of taking corporate welfare. But if people realizethat Sanders' measure would harm and potentially stigmatize workingpoor people who receive government benefits, the move couldbackfire. Also, Sanders' attempt to paint government benefits ascorporate welfare might ring hollow with voters, given that most ofthose benefits are already partly paid for via taxes on highearners:

|

A better approach would be to simply raise the minimum wage to$15, or preferably to a living wage based on the local cost ofliving. The government should also raise the earned income taxcredit, which is essentially a government subsidy encouragingcompanies to pay their workers higher wages. An expanded EITC —which Sanders ally Congressman Ro Khanna of California supports —might be the kind of thing that Sanders regards as corporatewelfare. But in the end, if the dollars are going into the pocketsof the poor, the question of how they get there is kind ofacademic.

|Democratic socialists have focused a lot on optics and onhigh-profile denunciations of the rich. But in the long term,promoting policies that fail on the merits is unlikely to helptheir cause.

|This column does not necessarily reflect the opinion of theeditorial board or Bloomberg LP and its owners.

Noah Smith is a Bloomberg Opinioncolumnist. He was an assistant professor of finance at Stony BrookUniversity, and he blogs at Noahpinion.

|Copyright 2018 Bloomberg. All rightsreserved. This material may not be published, broadcast, rewritten,or redistributed.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.