Although more people recognize that there is a retirementsavings crisis in the U.S., many don’t know how to educate peopleabout what it means to save for their future. Casual video games,cartoons and mobile phone apps are the newest ways companies andnonprofits are trying to reach people with financial education.Here are three of the most popular (and innovative) examples.

|Kicking around the financial football

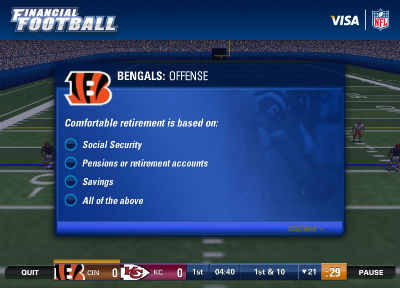

(Image courtesy Visa Inc.)

Visa Inc. has been developing financial literacy programs forall age groups since 1995, using unique means to reach people inways that they learn best. The company relaunched its FinancialFootball and Financial Soccer games in 2010 because it wantedto bring financial information to people through things they arepassionate about, like professional sports and video games.

|“We’re not trying to be trendy. Learning about money managementis perennially painful for people. It is scary or they have guiltbecause they are not doing well enough,” said Jason Alderman,senior director of financial education for Visa Inc. “It is veryhard to get people to engage, but the fundamentals haven’t changedin eons. Budgeting, saving, responsible spending and the good useof credit, those principals are already in place. The challenge ishow to make it compelling. How do you take this scary subject anddemystify it and make it easy to access.”

|Today’s consumers are attached to their gadgets, so reachingthem on those gadgets “makes the subject a lot easier to accessthan if it was coming from on high from a teacher, in a lecture orseminar,” Alderman said.

|Visa sponsors the NFL so it thought, “why not take thehigh-profile assets of the NFL and the people who have a realpassion about football. People care strongly about their NFL team,so let’s harness that passion to make it fun. That’s when FinancialFootball came about,” he said.

|In the game, the player gets to choose which team he or she isplaying for and who their rival will be. The game is played likereal football, but to complete a play, the player must answerfinancial questions about everything from savings and interest toIRAs and 401(k)s. The goal of the game is to get people familiarwith financial terminology.

|“That’s one of the off-putting things for people. A lot ofbanking and financial terminology is mystifying. We teach a lot ofdefinitions so people understand what words mean,” he said. Thegame provides different situations that involve finances to helppeople learn and grow their financial knowledge base as they playand advance through the different levels.

|When the game was first launched in 2004, it targeted middle andhigh school students. Teachers used it in classrooms to teachfinancial education. But recently, the military and for-profitcorporations have shown an interest in the game to open thedialogue about saving, investing and getting out of debt.

|A report by The Patrick Collins Group, LLC in 2011 looked at themany educational tools people use to improve Americans’ FinancialLiteracy. It found research from the University of Florida thatsupported the concept of online games as a means of education.

|The researchers observed students who played educational videogames over an 18-week period. Students who played the games didbetter on district benchmark exams than students who had not playedthe games. Students who played the games made gains of 8.07 points,out of 25, while students who didn’t play the games only increasedtheir scores by 3.74 points.

|“One reason for the greater gains is that games provideimmediate feedback when things go wrong and rewards when they donot. Recognizing the power of this type of educational engagement,financial organizations are moving to change the way they deliverinformation to consumers,” the report found.

|Visa’s Financial Football game was tested at 17 West Virginiahigh schools. Students were tested on financial concepts beforethey played the game, and 53 percent answered half or more of thebasic financial questions about common financial tools, such aschecking accounts, incorrectly, according to The Patrick CollinsGroup report. “By the end of their online experience, 92 percent ofthe students correctly answered such questions, as well as moresophisticated questions, about interest rates and risk. This wasthe result of having been exposed to the information repeatedly asthey attempted to improve their scores in the game.”

|Next: Taking a bite out of retirement

||

Taking a bite out of retirement

The Doors to Dreams Fund (D2D), a not-for-profit based inBoston, also has tried to harness technology to provide what itcalls financial entertainment.

|The company has a number of video games that address everythingfrom how to get out of debt, save money and build assets to how touse a tax refund.

|Its retirement game, BiteClub, tries to capitalize on people’s love of all thingsvampire and their addiction to online games like Diner Dash andFarmville as they run a nightclub for vampires. The goal is toteach lessons about retirement, said Nick Maynard, director ofinnovation for D2D.

|Bite Club is a simulation that takes players from their early20s through their 60s through 15 rounds of game play, forcing themto practice making key financial decisions, like reducing debtbefore they can invest more in their nightclub. It also teachesthem retirement saving strategies and how to balance spending moneyon what they want vs. what they need.

|He calls the work they do “chocolate-covered broccoli” becausethe organization is taking concepts and ideas that are good foreveryone to learn and making them palatable.

|“How can we leverage cultural touch points, like games, toencourage people to engage in topics and content that is valuableto them?” he asked.

|People love casual games, like Angry Birds, Bejeweled andTetris. They are easy and quick to play. They are not hard tolearn. That’s what D2D wanted to bring to the financial educationspace.

|“We wanted to reduce anxiety and stress. People get stressed outwhen dealing with financial literacy topics. By leading with fun,farms and vampires, by framing things in those ways, we want to getpeople engaged in things that seem very pleasurable. It helps withlearning and cognitive outcomes. When people have less stress andanxiety, they are more prone to take in what they areexperiencing,” Maynard said.

|D2D builds assessments and testing into all of its games, and sofar the organization’s games have been very successful. Peopleexperience double-digit increases pre and post play.

|Besides Bite Club, D2D has some very successful financial gamescalled Celebrity Calamity, which discusses credit card debt, andFarm Blitz, that teaches about interest, compounding anddiversification of assets. The goal of all of these games is to getpeople to take real world action, Maynard said.

|Staples partnered with D2D to offer Bite Club to its employees.It adapted the game to include links to the company’s retirementplan website. The goal is to get employees to either put moneyaside in the company retirement plan or up their retirement plancontributions.

|“Through this partnership, creative marketing has come out ofit,” Maynard said. Staples used vampire posters to get peopleinterested in the game. Instead of sending out big packets offinancial information nobody will read, they advertise the game toget people moving in the right direction.

|There has been strong interest in the game, with more than 9,500visits to the game portal. In direct mail tests, the response hasbeen in the 3.5 to 4.5 percent range. The average response fordirect mail is 2 percent, so “we’re very excited about it,” hesaid.

|Staples launched the game in September 2011 by hosting a BiteClub tournament at a certain number of its stores. There was an 80percent response rate to the tournament. New York Life, which isStaples’ retirement plan provider, said that it had an 11 percentresponse rate from one postcard it sent out about the game, meaningthat 11 percent of the Staples employees who received the card wentto the New York Life site and enrolled in the plan or increasedtheir retirement plan contributions.

|Next: Animation as financial motivation

||

Animation as financial motivation

Aspiriant, a U.S.-based wealth management company, has taken adifferent direction in financial education. The company felt thatit wasn’t doing a good enough job of educating potential clientsabout the benefits of having a financial advisor, so it came upwith the idea of putting ashort animated feature on its website to help educate its moreaffluent clients about the benefits of financial advice.

|Cammie Doder, director of business development at Aspiriant,said that she stole the idea from JetBlue, which used a cartoon togive its safety demonstration.

|“It was the only time I’ve watched the safety demonstration. Ithought it was clever. Safety is important, so you can’t have toomuch fun with it, just like our clients’ financial lives. We haveto be serious, but we can have some fun with it,” she said. TheJetBlue safety video struck a nice balance because it gave therequired information but was “engaging from start to finish,” shesaid.

|Aspiriant’s cartoon tells the story of what the company can dofor its clients, using a fictitious cartoon character named Tom,who is based on many different client case studies.

|“We are so passionate about what we do in terms of helping ourclients in so many facets. We help our clients be good stewards oftheir wealth. We want our prospective clients to see the power itbrings to them and their family, and the control,” Doder said. “Wehope our animated video helps them understand this offering andwhat it would bring to their families.”

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.